ST PAUL, Minn. — The term is tax incidence -- a way of measuring the relative tax loads on different income groups.

The latest one, done by the nonpartisan research staff at the Minnesota Department of Revenue predicts that lower-income and middle-income households would be hit harder, percentage-wise, if all of Gov. Tim Walz's tax proposals were to become reality.

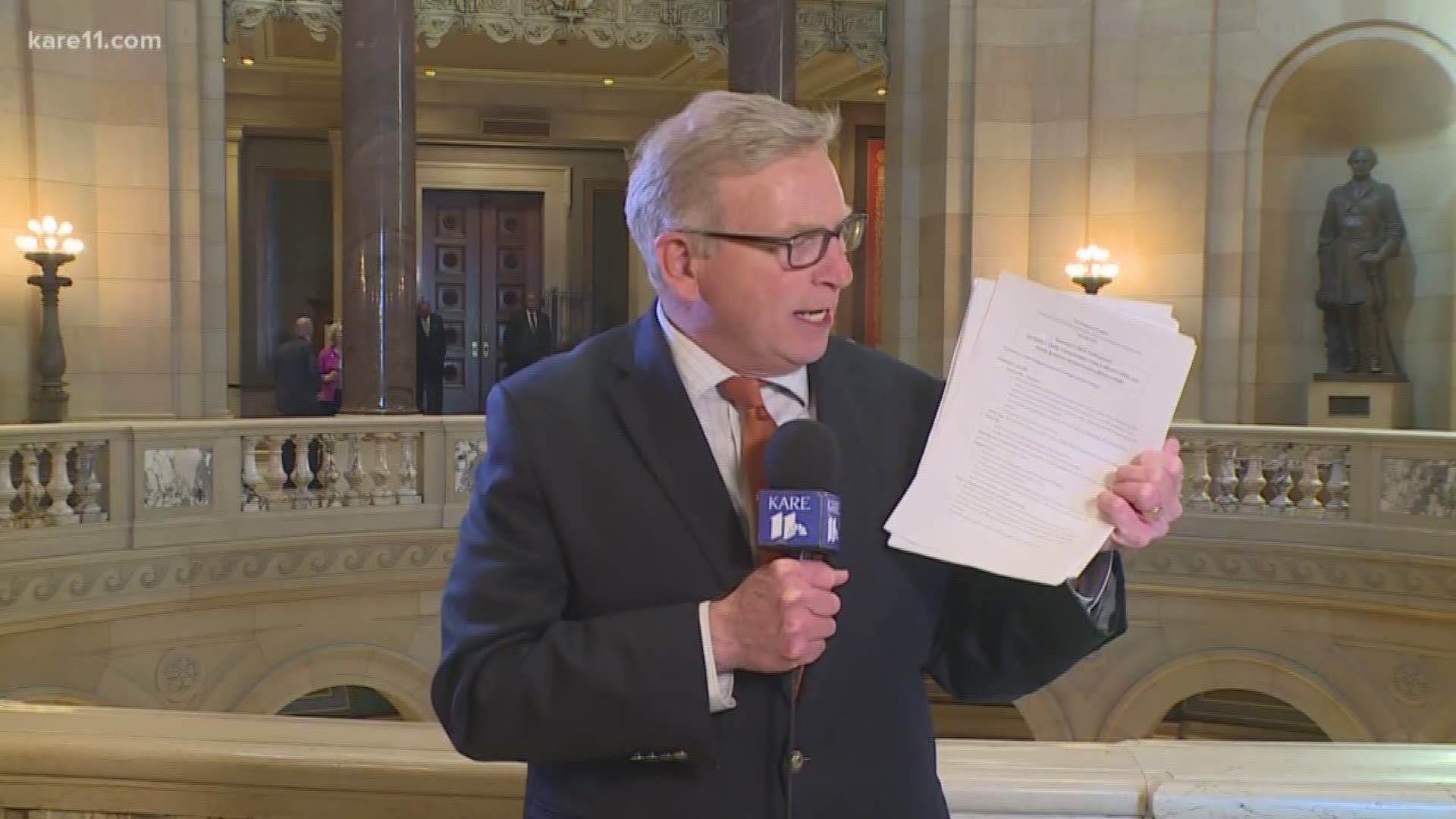

The tax incidence study released April 23 compares how much we'll pay in the year 2021 if nothing happens, compared to how much we'd pay if the legislature approves Gov. Walz's budget, which includes both tax hikes and tax relief.

The study divides households into ten equal groups, or deciles. The bottom five groups, covering incomes below $57,679, would see a great tax increase percentage-wise than the five income groups that earn more than that.

Households in the $14,529 to $23,941 range would see the single highest jump in tax burden, at 12 percent. By comparison, households with over $185,000 in annual income would see a 4.4 percent increase in burden.

One big tax change would come from the governor's proposed 20-cent per gallon gas tax. It's considered a regressive tax, because everyone pays the same amount regardless of income.

Analysts also factored in the governor's efforts to extend the life of the Medical Provider Tax. It's been on the books for decades, but it's scheduled to end this year. If you apply current law, it won't exist in 2021, so for purposes of this study the Revenue Dept. counted the provider tax as a "new" tax.

Gov. Walz welcomed the study, but said it doesn't tell the whole story, including the fact the provider tax pays for services that benefit lower income Minnesotans.

The study assumes doctors and hospitals will pass along that tax to patients of all income levels, but it doesn't consider those medical taxes are dedicated to health services used primary by lower income persons.

"Removing the Provider Tax would on paper look like we reduced the tax burden on those people, but we know a lot of them would be kicked off Medical Assistance and Minnesota Care if the provider tax went away and that would bankrupt them and have other repercussions."

Republicans touted the study, and asserted it further justified their opposition to tax increases. They brought it up repeatedly during the debate on the House Tax Bill Thursday night.

"His tax proposals actually attack the middle class, and so we'll have more discussion around this," Senate Majority Leader Paul Gazelka told reporters Thursday.

"I love when we have data that points to it. And frankly it's data from the Department of Revenue so nobody can say it’s fake news."

House Majority Leader Ryan Winlker said overall middle-class Minnesotans stand to benefit overall from the DFL House budget, which includes many of the same taxes.

He said it's misleading to call the medical provider tax a new tax on sick people, as GOP lawmakers assert.

"That provider tax has provided a foundation of health security for hundreds of thousands of working poor and poor Minnesotans," Rep. Winkler remarked.

"It is the bedrock of support for the health care and security of Minnesotans and it has been for a long time."

He noted all fuel taxes are regressive, and the proposed gas tax hike would be regressive. But he noted it's a user tax, which is all dedicated to roads used by people all income groups.