GOLDEN VALLEY, Minn. - Many young people who are just getting started in the working world may want to remember they're not just making money for now, they're also planning for the future. But they may also be wondering: where should that retirement money go?

Financial Advisor Dan Ament with Morgan Stanley joined us on KARE 11 Sunrise to talk about choosing the right retirement account.

401(k): Is there a "Match"?

"If you are eligible for an employer matching contribution, do your best to contribute at least up to the minimum amount required to maximize the matching contribution," Ament said.

The Employee Benefits Research Institute reports the average match is 50 cents on the dollar, at up to 6 percent of your income.

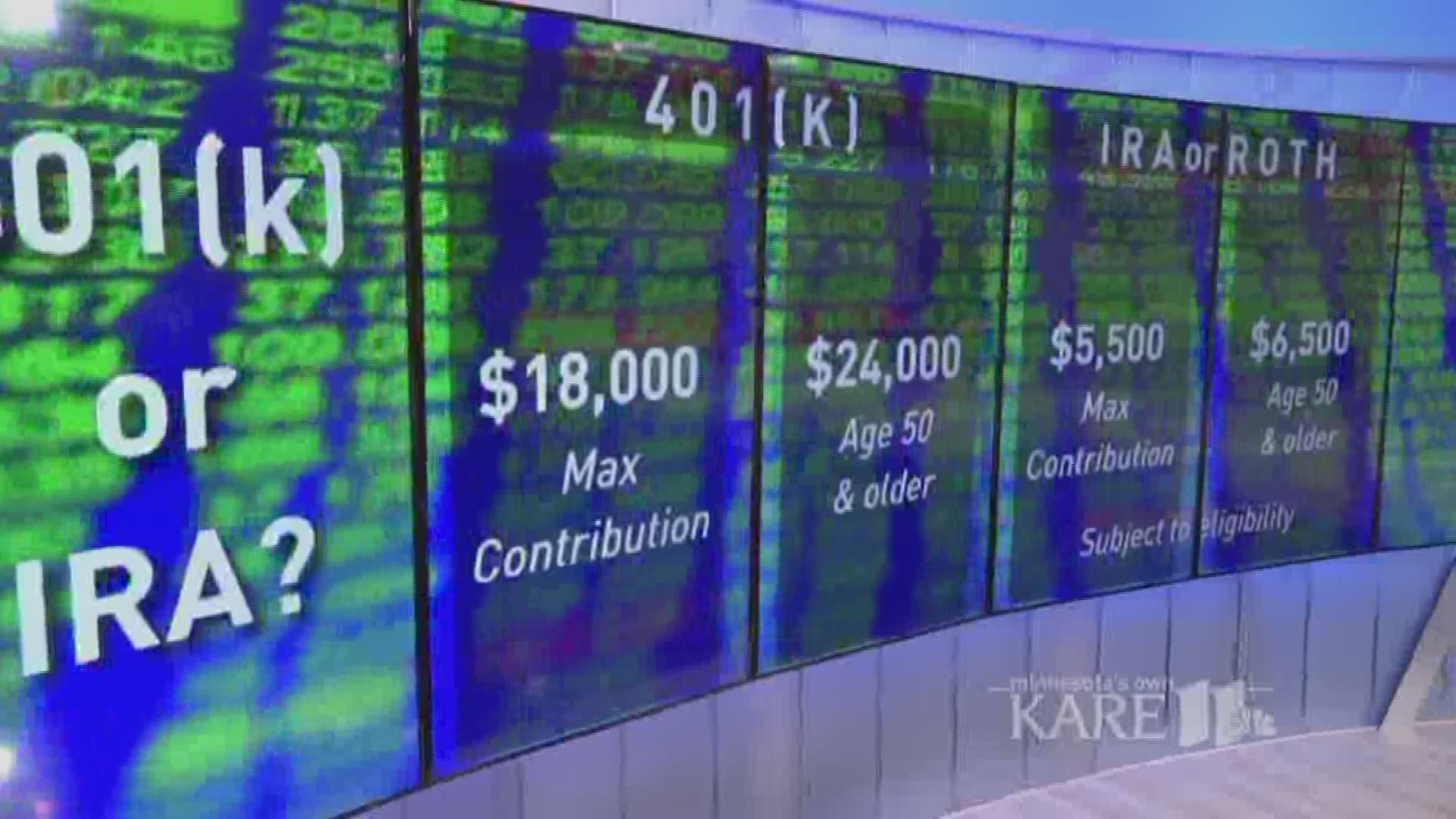

According to the IRS, the maximum 401(k) contribution you can make for 2017 is $18,000. Those age 50 or older can contribute an additional 'catch up' of $6,000 for a total of $24,000.

Fund an IRA or Roth IRA?

"Presuming you have maximized any available employer match with your 401(k), you can consider funding a Traditional IRA or Roth IRA with additional cash flow if you are eligible, per IRS rules," Ament said. "Some of the advantages of this strategy include a broader array of available investment options to select from as well as a unique feature offered with Roth IRAs, allowing you to access your principal investment (money contributed) at any time without tax or penalty if needed. This could allow you to use a Roth IRA as an 'Emergency Fund' while ideally keeping the money invested long-term growing tax-free for retirement."

The maximum contribution for an IRA or Roth IRA for 2017 is $5,500. Those age 50 or older can contribute an additional 'catch up' of $1,000 for a total of $6,500.

Do you have student loans or credit card debt?

Ament said if you have student loan or credit card debt, you may want to consider deferring any additional 401(k) contributions beyond the matching requirement, as well as IRA contributions, so you can focus any available cash flow on your higher cost debts to pay them down more quickly.

"Spend some time considering your available income for savings and wisely allocate it to the available investment vehicles based on your unique situation. You will thank yourself in a few years if you do!" Ament said.