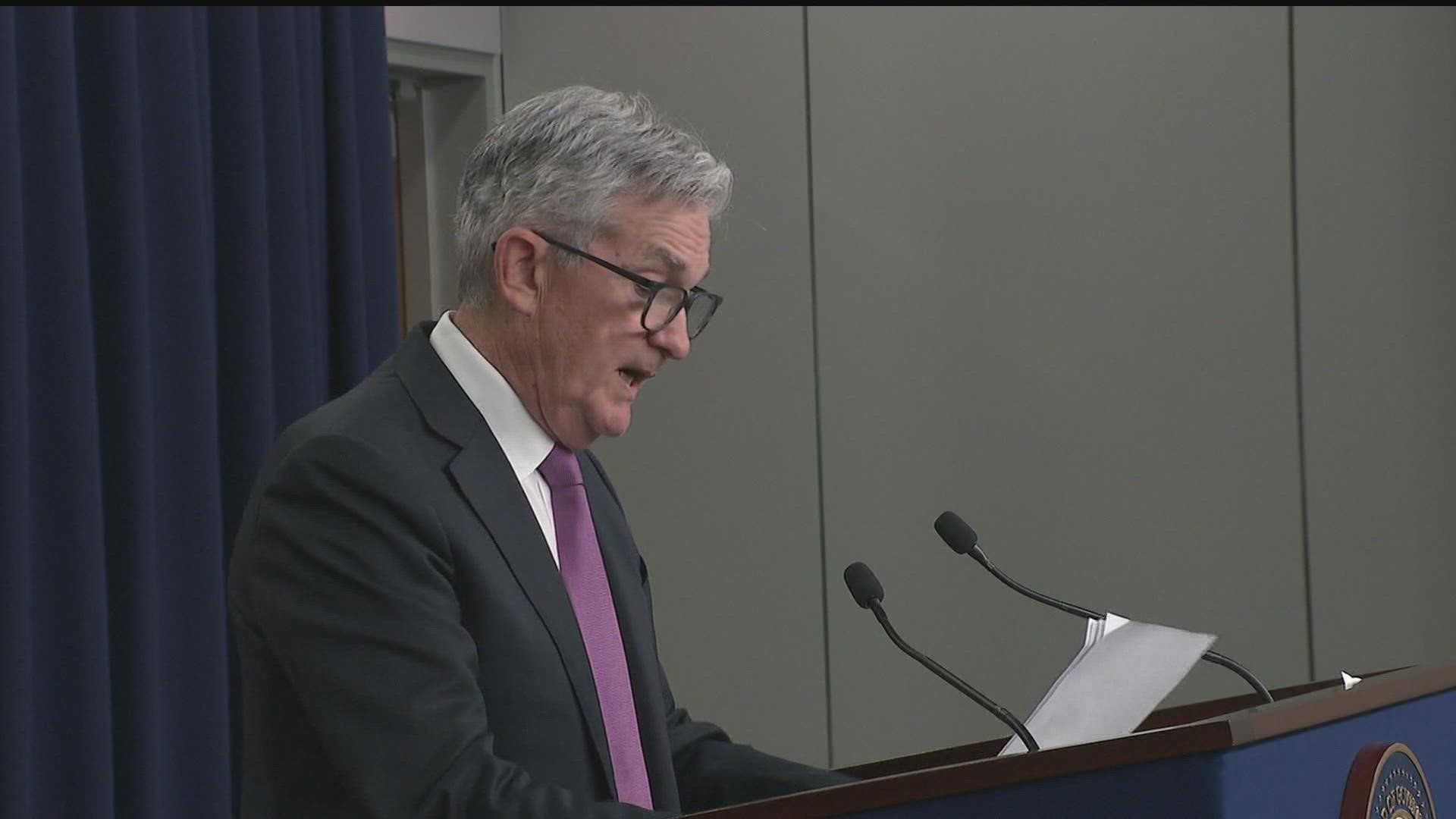

MINNEAPOLIS — As economists expected, the Federal Reserve raised interest rates by .75% Wednesday for the fourth time this year and Murray Frank, a Piper Jaffray endowed faculty fellow and finance professor at Carlson School of Management, says as a result, interest rates on things like car and home loans are likely to rise again, too.

"If you raise the interest rates, fewer people will decide to buy and that was the purpose," Frank said.

Softening the demand — it's the Fed's way of trying to fight soaring inflation and what happens next depends on your financial situation.

"Somebody who is at or near retirement, who has saved up a bunch of money … all the inflation just took away large chunks of what they had saved up," Frank said. "By raising the interest rates, they slow down the rate at which those people become poorer. Possibly, those people will start to get somewhat higher interest rates on their savings and therefore they will benefit."

Frank says people who depend on borrowing money should be aware that doing so is going to become more expensive.

Frank also explained this interest rate hike — or softening of demand — is an effort to cool off the job market. Right now, all kinds of industries are hiring — many companies are desperate for help. However, that's expected to change.

"Based on what the Fed is doing, it is likely that six months from now, it'll be harder to find a job," Frank said. "If you're unemployed, now is the time to take a job. You don't wait around because it is going to get harder. In the same way, if you're thinking about buying a house, lock in the interest rates now. They just went up. It would have been better to do it a few months ago, but the Fed just told you it's going to get worse in a few months."

The next interest rate hike could come as soon as September. Frank says, if you have debt based on a floating interest rate, such as credit card debt or a floating rate mortgage, either pay them off, which is best, or figure out a way to lock in the rate now so that it doesn't go up along with everything else in September.

Watch more local news:

Watch the latest local news from the Twin Cities in our YouTube playlist: