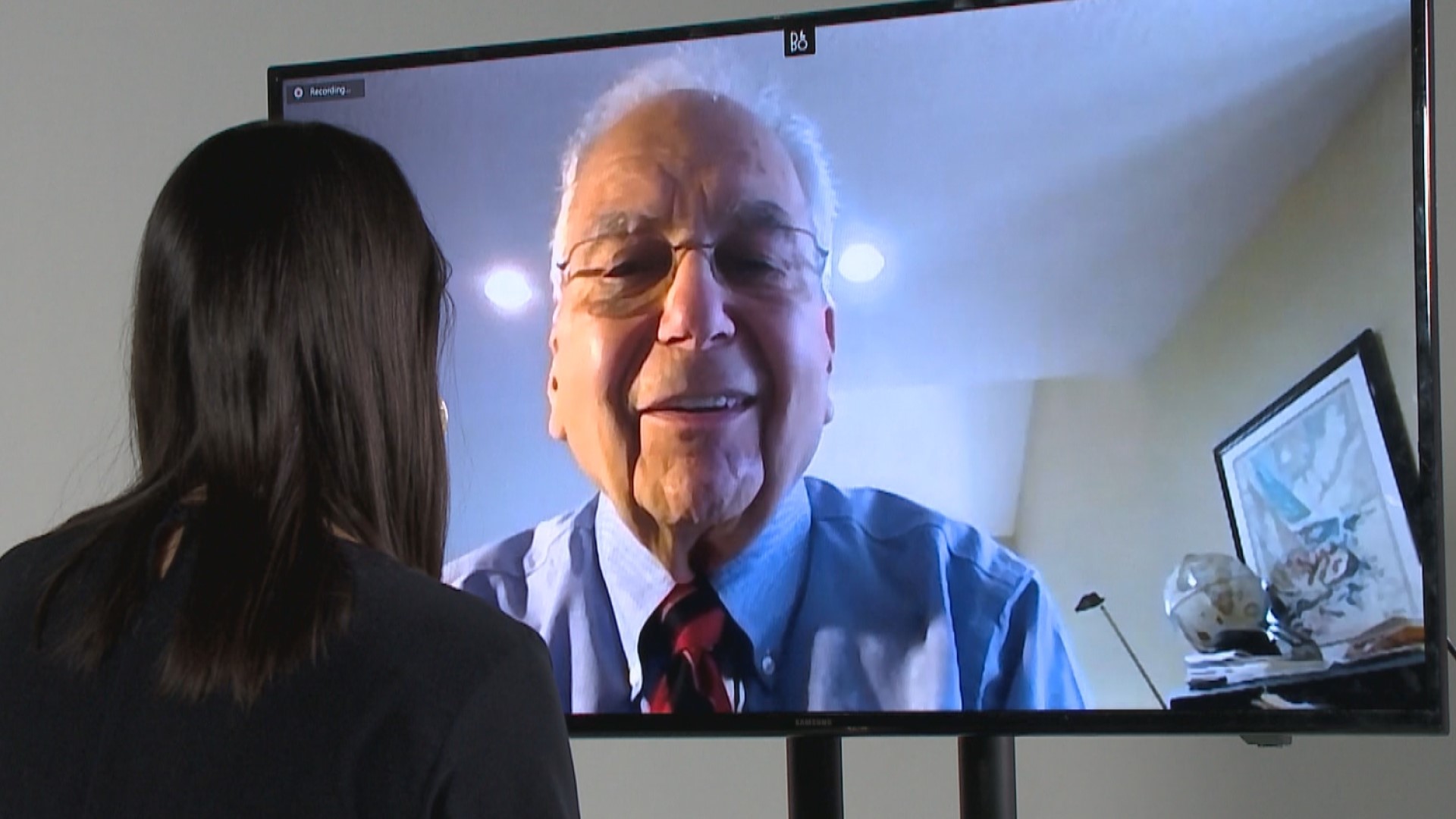

MINNEAPOLIS, Minnesota — Herbert Schechter knows a thing or two about taxes.

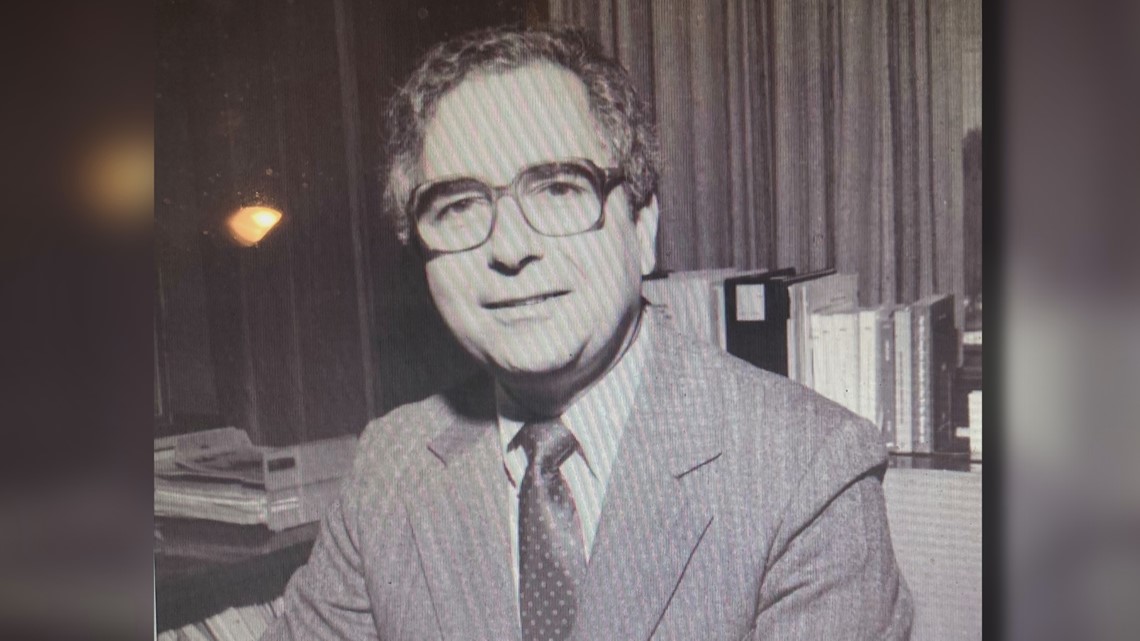

He started preparing people's tax returns in 1957 while in college at the University of Minnesota. Schechter said because the Minnesota Board of Accountancy gave him credit for the work he did in college, he became a certified public accountant (CPA) in 1960 at the age of 22.

"At that time, I was the youngest CPA in the state of Minnesota and I'm working on becoming the oldest," the 83-year-old said.

Schechter is a member of the Minnesota Society of CPAs and now works for a portfolio management firm. He recalled what federal income tax brackets looked like when he first started in the late fifties.

"The top tax rate for individuals was 91%. So now the tax rate is 37.5% and people are complaining. So they don't realize how bad it could be," Schechter said.

Schechter prepared his first returns using carbon paper. If he made a mistake, he would need to start over. In 2022, 90% of returns are expected to be filed electronically, according to WalletHub.

Schechter said the tax system was much simpler when he first started.

"You basically had your basic income, you had deductions, you had a $600 exemption for yourself, for your spouse, for each of your children, and you calculated the tax. Now you have many tax returns inside a tax," Schechter said. "Just in the last couple of years, they've added more than a million words to the Internal Revenue Code. So this is only possible because we have computers. Because without computers, the complexity is so great that unless somebody has a very simple return, you need a computer to figure out all the interrelationships. The Internal Revenue Service wouldn't be able to monitor these or audit without computers. It would just be too much for anybody to keep in their head."

Schechter added, "Today the tax system is being used as an instrument of public policy, not merely to raise money to run the government. So if they want me to buy an electric car, then they give me a $7,500 credit on my tax return to do that. If they don't want me to do something, then they charge me extra for doing that."

One thing that has not changed is some people will always wait until the last minute to file their taxes.

"Some on the last day, they would say, 'Well, I can't get this together; get me an extension.' So they get an extension for six months and they wait for five months and three weeks to get the final information in."

Schechter called that the difficult part of being a CPA or "professional worriers" for their clients.

But with 65 years of experience, Schechter said, "I get a lot of satisfaction from doing a tax return. It's kind of like a mantra that you have this procedure that you go through and a system and you're like repeating the same things. So for the same reason people do meditation or whatever, I find it's very meditative to do tax returns."