GOLDEN VALLEY, Minn. - Have you tried to take out a loan lately? Open up a credit card account? Buy a house? Then you should be familiar with your credit score. However, at least 11-percent of Americans say they have never checked their credit score.

Financial advisor Dan Ament from Morgan Stanley in Wayzata joined us on KARE 11 Sunrise to talk about ways to manage and rebuild your credit score.

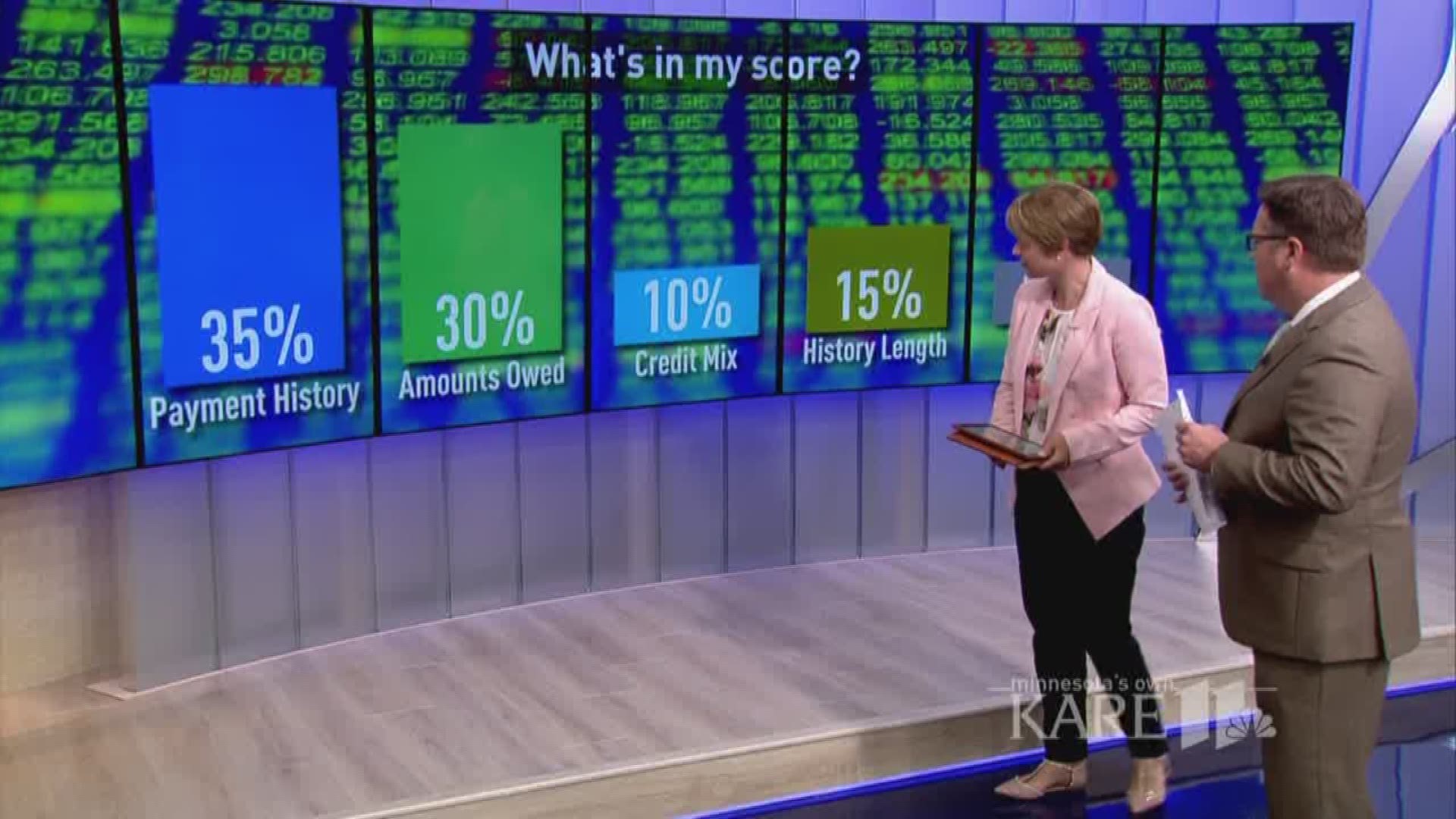

First, you need to understand what's in your credit score:

- 35% is based on your payment history

- 30% is based on the amounts you owe

- 15% is based on the length of your credit history

- 10% is tied your credit mix

- 10% is based on new credit

Ament offered these suggestions to improve your credit:

Check Your Credit Report

"Credit score repair begins with your credit report," Ament said. "If you haven't already, request a free copy of your credit report and check it for errors. Your credit report contains the data used to calculate your credit score and it may contain errors. In particular, check to make sure that there are no late payments incorrectly listed for any of your accounts and that the amounts owed for each of your open accounts is correct."

Dispute Inaccuracies

"To insure that an error gets corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau," Ament suggested. "Both of these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act. The credit bureau must investigate the items in question – usually within 30 days – unless they consider your dispute frivolous. Include copies (not originals) of documents that support your position."

Set Up Payment Reminders

"Making your credit payments on time is one of the biggest contributing factors to your credit scores," Ament said. "Some banks offer payment reminders through their online banking portals that can send you an email or text message reminding you when a payment is due. You could also consider enrolling in automatic payments through your credit card and loan providers to have payments automatically debited from your bank account, but this only makes the minimum payment on your credit cards and does not help instill a sense of money management."

Pay down debt

"This is easier said than done, but reducing the amount that you owe will not only help improve your credit score, it will bring great peace of mind to your financial life. The first thing you need to do is stop carrying balances on your credit cards. Use your credit report to make a list of all of your accounts and then go online or check recent statements to determine how much you owe on each account and what interest rate they are charging you. Come up with a payment plan that puts most of your available budget for debt payments towards the highest interest cards first, while maintaining minimum payments on your other accounts."