GOLDEN VALLEY, Minn. - The holidays bring reflections on the year that has passed - have you been acting as the Chief Financial officer of your household?

The new year would be a great time to consider giving yourself a promotion to CFO. While the new job may not come with a corner office and stock options, it should pay off immensely in your future.

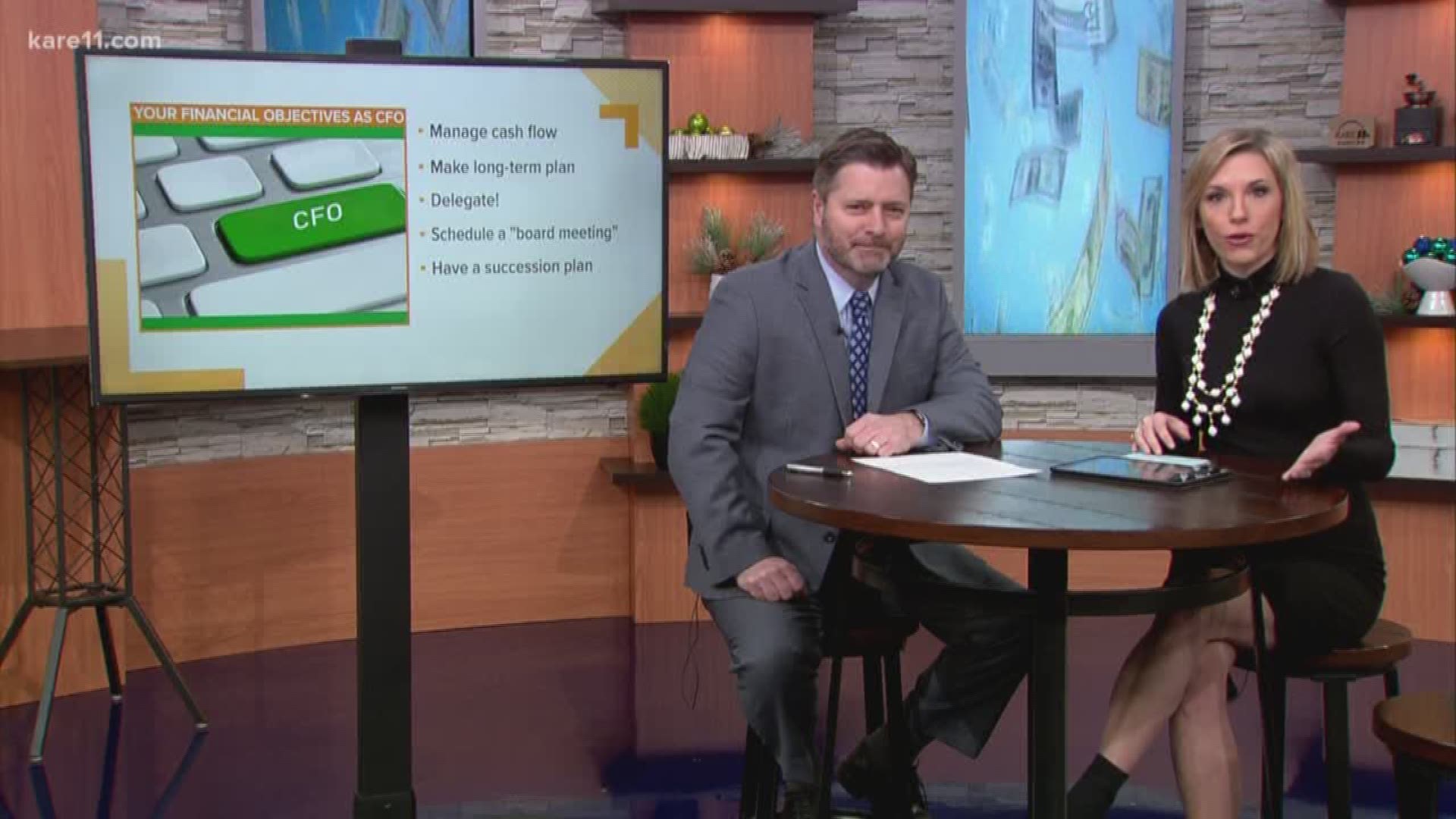

Dan Ament, Financial Advisor with Morgan Stanley, joins is with KARE 11 Sunrise to help you build an executive plan for your finances. Here are your financial objectives as CFO of a household:

Manage your cash flow

Before you can make any long-term financial goals, you need an understanding of how you're spending money. This starts with a budget. For some, the process of examining how much and on what items or services we spend may be an unpleasant exercise. That said, if you are facing ‘negative cash flow’ (spending more than you make), a CFO realizes this is a sure path to financial demise. Making a budget will uncover opportunities to save money (cash flow) to be redirected towards debt reduction or building a cash cushion in savings (emergency fund). If you successfully establish a budget and make positive changes to your short-term cash flow picture, give yourself a reasonable bonus as CFO. Enjoying a reward after achieving a goal is a great motivator!

Establish a long-term plan

In addition to the day-to-day (your budget), as CFO you will want to establish a plan for your long-term financial goals. Visualize your financial future and the resources that will be required to finance them. A written goal that is revisited is far more likely to be achieved. Often, short-term needs & wants are prioritized over future financial goals that seem distant and sometimes too difficult to achieve. The key to implementing a successful long-term plan as CFO is to find balance in your financial life – successfully managing day-to-day as well as planning for the future.

Delegate where needed

A successful CFO knows the importance of building a team around them and to delegate tasks to various specialists when needed. Your household is no different. As CFO, consider aspects of your financial picture that could benefit from outsourcing to a professional. These may include a tax advisor to assist with projections and tax preparation, an attorney for help with your estate planning needs and a financial advisor to assist in building a financial plan and related investment strategies.

Schedule a board meeting

Talking about money isn’t a first topic choice for most couples or families. Top CFOs can’t hide from hard conversations. Instead, they schedule a meeting to discuss and address any issues that are occurring. As CFO, schedule time to discuss with your spouse, partner and family the financial topics that should be addressed. It may be a conversation about the need to curb spending to better manage cash flow as a family. Other topics could include the importance of planning ahead to save for college education or saving for a shared family goal such as travel plans. Communication is key and it can be difficult at times ….. for all of us.

Have a succession plan

A well-prepared CFO knows that a succession plan is also an important component of long-term planning. Your succession plan should include reviewing or creating your estate plan (especially writing a will) and important related documents such as your healthcare power of attorney and durable or financial power of attorney.

More financial news from KARE 11 Sunrise