MINNEAPOLIS — People often say money can't buy happiness, but it can buy comfort, a comfortable lifestyle and a comfortable retirement.

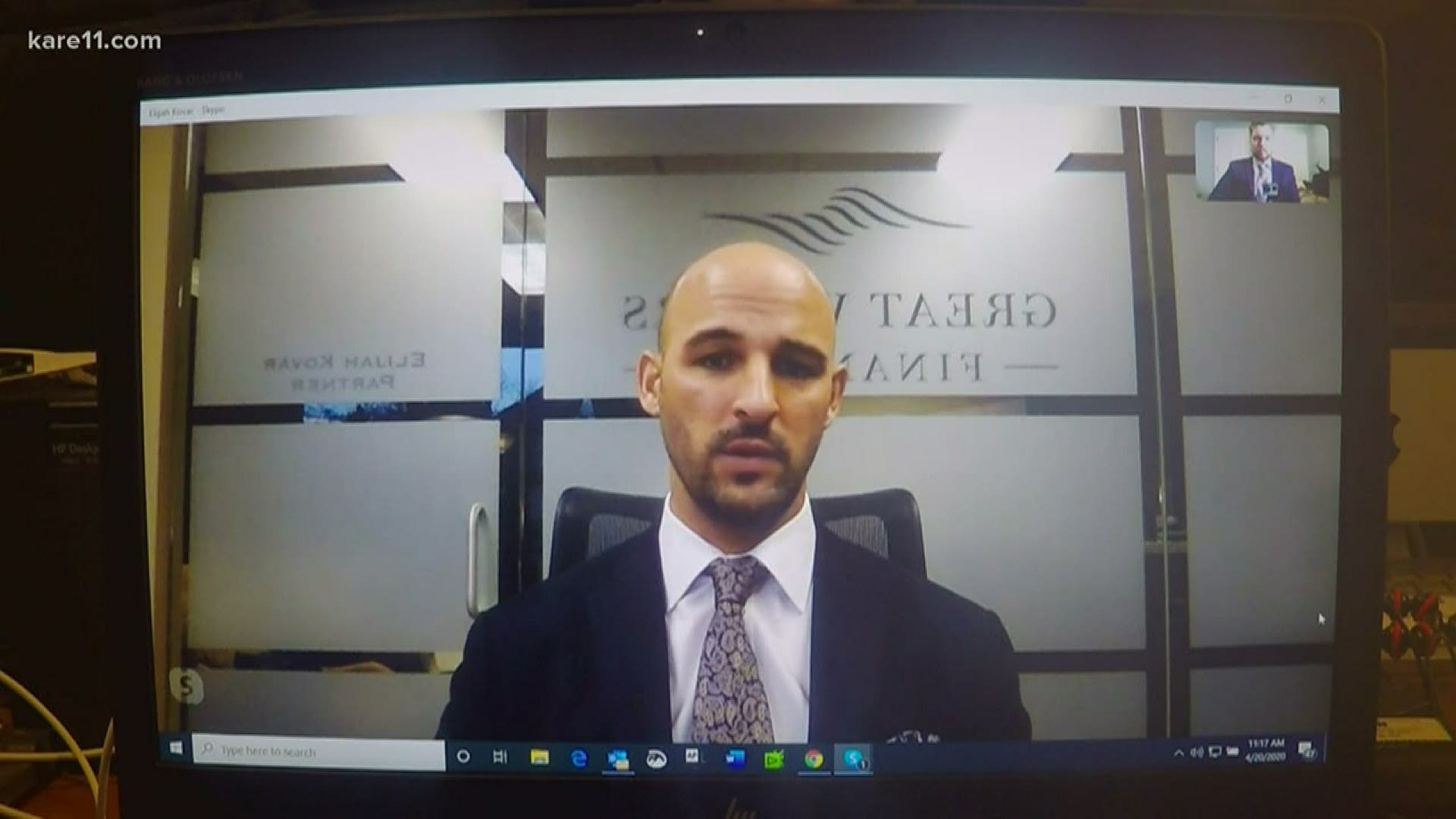

But after so many years of making money in the stock market, Great Waters Financial advisor Elijah Kovar says many Americans got a little too comfortable.

"It seems that people forgot the market could go down,” Kovar says.

And down it went.

Many Americans lost 15%, 20% or even 25% or more of their retirement in just a matter of weeks.

"First and foremost, tune out the fear. I don’t know a time in my life where a fear-ridden decision was a good decision,” Kovar says.

If you're less than five years away from retirement or newly retired, Kovar says you might not be in as bad a shape as you think.

If you had a plan in place, or were less risky with your money, you might be surprised to see how well your retirement account is doing.

“We had a client that called in last week and talked to one of our advisors and he was freaking out thinking his portfolio had diminished and when they looked at it he was only down 4%. He goes oh, that’s all?” Kovar says.

That’s because retirement planning isn’t a “one size fits all” situation. Kovar says every person and plan is different.

“You need to understand your numbers and know that your situation is unique. You may be just fine, or, if you didn't plan for this, you may have to readjust your plans."

Even if you've lost 20% or more of your retirement, you might still be okay with Social Security payments and other investments that might be able to keep you going until you get that lost money back.

"Find out what your numbers say, not what everyone is saying you should be concerned about," Kovar says.

But he's not going to lie, some people are in a tough spot right now and might have to push back their retirement a few years or hold off on some travel plans for a while.

Even if that's your situation, Kovar says now isn't a time to panic, it's a time to learn and make a better plan for the future.

"This is a pandemic. It could cause lasting change in the markets that could take us a few years to dig out of. What we need to do is we need to plan for the worst. We need to know if this persists, and if there is a five year recession, do we have a plan that can withstand that."

If you're more than five years away from retirement, financial experts say now is a great time to buy, because you're getting everything at a discount.

But before you buy, they recommend putting a plan in place that will keep you on the right track for retirement even if the economy takes another turn for the worst.

MORE NEWS: If you didn't file your taxes in 2018 or 2019, here's what you need to do to get a stimulus check

KARE 11’s coverage of the coronavirus is rooted in Facts, not Fear. Visit kare11.com/coronavirus for comprehensive coverage, find out what you need to know about the Midwest specifically, learn more about the symptoms, and see what companies in Minnesota are hiring. Have a question? Text it to us at 763-797-7215. And get the latest coronavirus updates sent right to your inbox every morning. Subscribe to the KARE 11 Sunrise newsletter here. Help local families in need: www.kare11.com/give11.

The state of Minnesota has set up a hotline for general questions about coronavirus at 651-201-3920 or 1-800-657-3903, available 7 a.m. to 7 p.m.

There is also a data portal online at mn.gov/covid19.