WASHINGTON — Members of Congress united across party lines to demand answers about how the Department of Veterans Affairs plans to refund hundreds of millions of dollars owed to tens of thousands of disabled veterans.

In a letter sent to VA Secretary Robert Wilkie, a bipartisan group of 17 lawmakers from both the House and Senate asked for a detailed "plan of action" to repay $286 million to veterans who were overcharged when they participated in the VA Home Loan Guaranty Program.

“We are writing to raise our significant concerns regarding hundreds of millions of dollars in funding fees owed to our nation’s veterans by the Department of Veterans Affairs (VA),” the lawmakers said.

The letter – also signed by the chairs of two Congressional subcommittees which oversee the VA – is the latest development in the wake of an ongoing KARE 11 investigation.

In May, KARE 11’s "Funding Fee Fiasco" investigation revealed that senior VA managers in Washington were warned about funding fee overcharges five years ago by officials in the St. Paul, Minnesota Regional Loan Center.

Despite that warning, KARE 11 reported that top VA officials failed to take corrective action.

In June, the VA’s Office of Inspector General (OIG) issued a report labeling what took place “troubling.” The OIG investigation found that veterans were not notified they were due refunds – and the overcharges continued.

Now, lawmakers are pressing the VA to take immediate action.

“It is totally unacceptable that tens of thousands of our nation’s heroes were charged enormous sums of money that they didn’t owe because of negligence at the VA,” said Representative Mike Levin (D-CA), Chair of the Veterans’ Affairs Subcommittee on Economic Opportunity. “The men and women who have served our country deserve better, and the VA must correct this situation immediately.”

Veterans due big home loan refunds

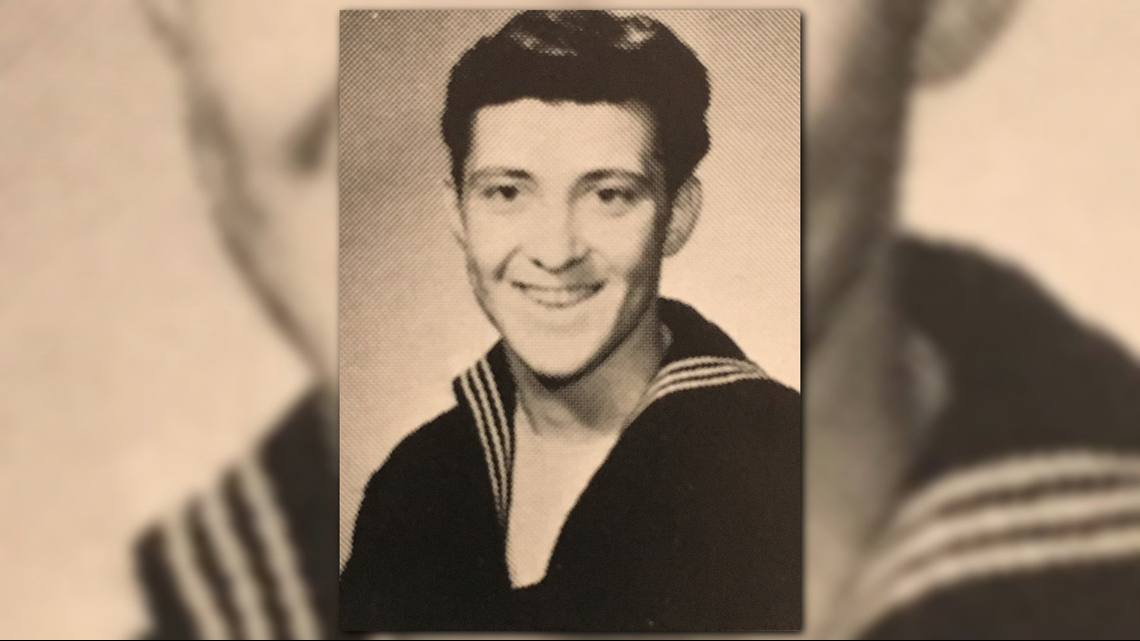

The government estimates that more than 50,000 veterans nationwide are owed money, including Roger Roath of Lakeville, Minnesota.

“I served in Vietnam off the Gulf of Tonkin from 1968 to 1969 – aircraft carrier,” Roath said proudly.

He’s had ringing in his ears ever since. So, in 2011, he applied for a disability rating with the VA. After an initial denial, he appealed. His claim was eventually approved, but it took time.

“Approximately three years later,” he recalled.

While his disability case was still pending, Roger refinanced his loan as interest rates continued to go down.

“Twice - 2011 and 2013,” he said. He used the VA’s Home Loan Program both times.

Veterans who use the VA program are generally required to pay what’s called a "Funding Fee" – up to 3.3 percent of the loan amount. In Roger’s case that added up to thousands of dollars.

For disabled veterans, however, that funding fee is waived.

Since Roger’s disability claim was still pending when he refinanced his VA loan, he had to pay the fee both times he refinanced.

But the VA’s own rules say that if a disability claim is approved after a loan is finalized – and the disability rating is made retroactive like Roger’s was – the veteran is due a refund of the funding fees.

For Roger, that totals more than $10,000.

Unfortunately, he says he didn’t know about that until he saw KARE 11’s investigative report in May detailing the problem in the VA’s Home Loan program. And he is not alone.

Whistleblowers say veterans weren’t informed

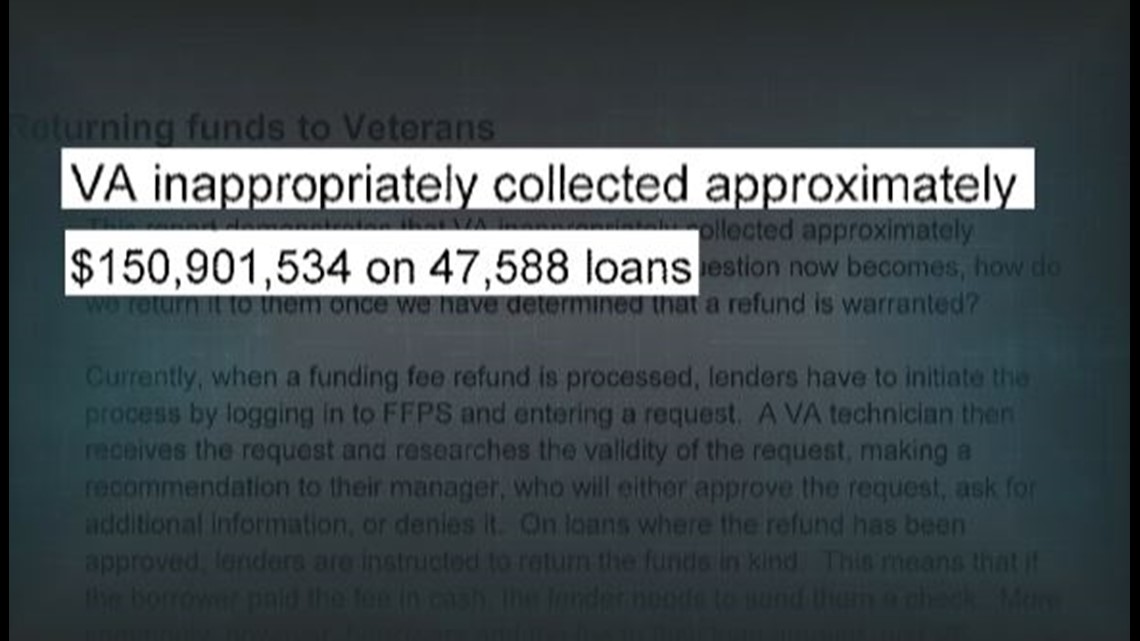

A whistleblower provided KARE 11 internal VA records that revealed a bombshell. Disabled veterans across the county who were owed home loan refunds weren’t always getting them, according to an analysis of funding fees done back in 2014 by employees at the VA’s St. Paul Regional Loan Center.

Between 2006 and 2014 “VA inappropriately collected approximately $150,901,534 on 47,588 loans,” their report concluded at the time.

Multiple VA insiders, speaking on the condition of anonymity to protect their jobs, said that high ranking officials at Department of Veterans Affairs headquarters in Washington, D.C., were informed of the issue five years ago.

Despite the warning, they said officials failed to ensure that veterans got the refunds they deserved.

Records show that Mike Frueh, then Director of the VA Loan Guaranty Program, and Deputy Director Jeffrey London were made aware in 2014 that veterans were being inappropriately charged and not being given refunds.

Frueh was later promoted to Chief of Staff for Veterans Benefits and Jeffrey London took over from his old boss and is now Executive Director of the Loan Guaranty Service.

The OIG report

The OIG investigation confirmed KARE 11’s findings that the managers had been warned about the outstanding debts owed to veterans and did nothing to rectify the overcharges.

“Disturbingly, as of January 2019, Loan Guaranty Service management had not taken action to issue refunds to these exempt veterans,” wrote VA Assistant Inspector General for Audits and Evaluations Larry Reinkeymer.

OIG’s report states, “Because inappropriate funding fee charges were not refunded, many exempt veterans may have suffered significant financial losses.”

What’s more, since officials didn’t act when they were alerted about the problem in 2014, the overcharges have continued.

“OIG finds it troubling that senior VBA management was aware that thousands of veterans were potentially owed more than $150 million yet did not take adequate actions to ensure refunds were issued,” wrote Reinkeymer.

The refund amounts veterans are owed are often substantial. The average funding fee charge was $4,483, with the largest topping out at $19,470, according to the OIG report.

Congress wants answers

"This is a large amount of money for the individual veterans," the lawmakers' letter to the VA Secretary reads. "It is unclear when veterans will see their reimbursement."

Not only do the Congressional leaders want detailed information about when veterans will be reimbursed, but they’re also asking how the VA plans to implement the necessary financial controls to prevent additional overcharges.

They gave VA a deadline of June 28th, to provide a briefing on the "plan of action."

Congressional sources tell KARE 11 that to date, VA has not responded.

Since April 26, KARE 11 has been requesting interviews with VA officials about the refunds owed to veterans. They have not responded.

But after failing for years to take action, the VA suddenly issued a press release on May 13, just two days before KARE’s first report, announcing major reform efforts are underway. The release also said VA is conducting an ongoing internal review looking at millions of loans dating back to 1998 to determine if additional refunds are needed.

“It is unsettling to hear that VA mistakenly charged veterans millions of dollars in home loan fees they didn’t actually owe,” said House Committee on Veterans’ Affairs Chairman Mark Takano (D-CA). “I call on VA to rectify the situation as soon as possible - our veterans deserve so much better.”

If you think you may be entitled to a refund of the funding fee, contact the VA Loan Center at 1-877-827-3702.

Additional information is available on the VA’s website.

If you’re one of the veterans who may be impacted, email the team working on this investigation at: investigations@kare11.com