COTTAGE GROVE, Minn. — Gary Spooner’s apartment is filled with life-long treasures of his alter ego – Santa Claus.

The 83-year-old, who bears a striking resemblance to St. Nick, has decorated the home he’s lived in for more than four years – floor to ceiling – with Christmas décor. Living on a fixed income, he’s figuring out what he can live without now that rents are going up in his affordable housing building by 12.5%.

“If you get an increase like that, and you look at your budget, you have to start thinking – what can’t I afford?” he said.

Spooner is one of hundreds of low-income seniors living in several suburban affordable housing apartment buildings financed with the help of federal tax credits who are all asking themselves the same question.

At a meeting in early June, residents at River North Apartments in Coon Rapids – another senior building – gathered with city and state lawmakers to loudly voice their worries and anger.

“I have to get a job or I have to leave,” one woman said.

“I’m paying 70% of my income to live here,” said another resident.

Those large rent increases are being imposed by Plymouth-based Dominium, which boasts being the “the nation’s 4th largest provider of affordable housing” with “over $3 billion in owned properties.”

More than 40 of them are marketed as affordable in Minnesota, serving thousands of lower income renters, including in more than 20 senior-only buildings.

To build those apartments, Dominium has relied on millions of dollars in tax credits. In exchange, Dominium can only charge rent based on a formula determined by the Area Median Income – or AMI.

Renters in the tax credit properties must meet income limits. Typically, they can only make 60% of the AMI. Meanwhile, federal rules require developers to cap rents at 30% of that AMI limit.

The AMI is calculated every year, and each time it goes up, so can the rent.

This year in the Twin Cities metro, the AMI went up 12.5 percent, more than double the national social security increase of 5.9 percent.

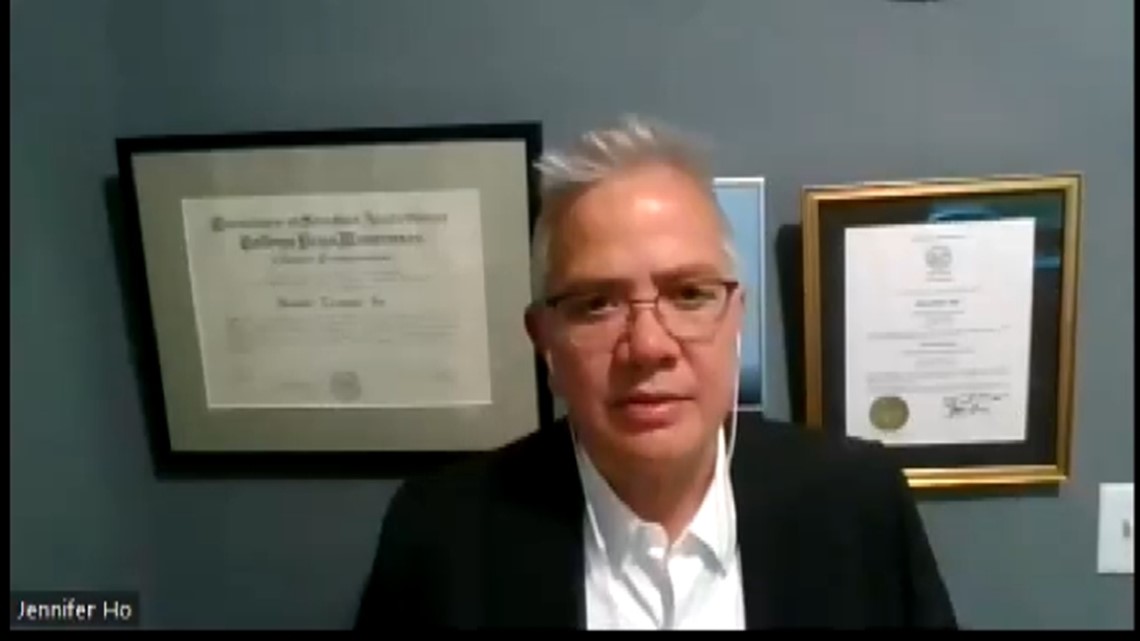

“It’s unprecedented,” said Minnesota Housing Commissioner Jennifer Ho of the large AMI jump.

She says that unprecedented increase has exposed a potential problem with the federal program – there’s no carve out for low-income seniors whose earnings are unlikely to go up with the AMI.

Under the current Low Income Housing Tax Credit (LIHTC) rules, Dominium’s rent increases are completely legal, but Ho says there is nothing in the rules that requires them to raise rents.

“Just because you can, doesn’t mean you should,” Ho said.

And those rent increases can be back breaking.

Residents at The Cavanaugh Senior Apartments in Crystal shared copies of their leases with KARE 11. They showed that rent for a one-bedroom apartment jumped from $1,115 per month last year to $1,251 this year – up $136 a month.

Seniors at The Cavanagh invited KARE 11 to a listening session with Dominium – but the company told us to leave.

Asked for an interview, Dominium instead provided a statement to KARE 11, in part saying, “We understand that costs for just about everything are increasing and we empathize with our residents and community members as food, housing and basic essentials cost more due to inflation. We are also experiencing higher costs as well.” (Click here for the full statement)

Legislators from both sides of the aisle are blasting Dominium for taking tax credits, then raising the rents at the maximum allowed.

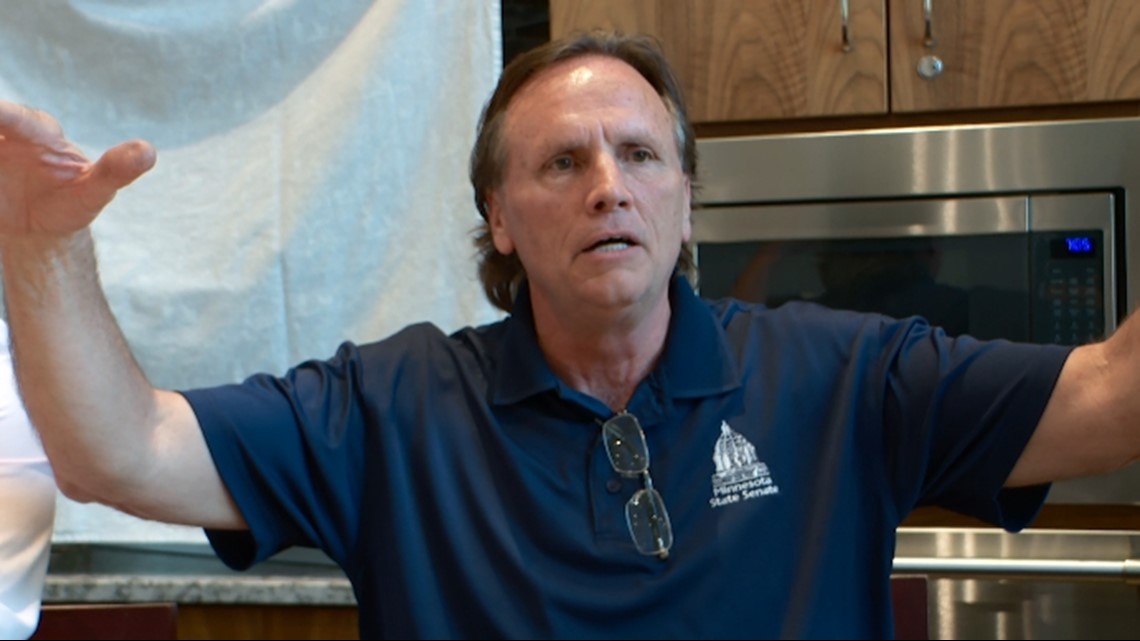

“They’re making money off the backs of poor seniors,” said State Sen. Jim Abeler, a Republican who represents many seniors living in Dominium apartments in his district.

At a meeting with residents at the River North senior complex in Coon Rapids, DFL Sen. John Hoffman slammed Dominium’s tactics as unethical.

“They got 11 million dollars of your tax dollars to build this,” he told them, fueling their outrage.

Four years ago, Minnesota Housing stepped in when Dominium wanted to raise rents mid-lease and the state eventually banned the practice for developers participating in LIHTC programs.

But while Commissioner Ho acknowledged that seniors could lose their homes because of this latest large rent hike, she said she is unsure of whether the agency can step in this time.

“I have charged my team with making sure they present me with everything I can do at the state around the federal program,” she said in an interview.

For seniors like Spooner, help can’t come fast enough.

“We have contributed to this nation for a long time and now we’re in our later years,” he said. “We want to be comfortable and don’t have the worries about where our next meal is going to come from.”

Watch more KARE 11 Investigates:

Watch all of the latest stories from our award-winning investigative team in our special YouTube playlist: