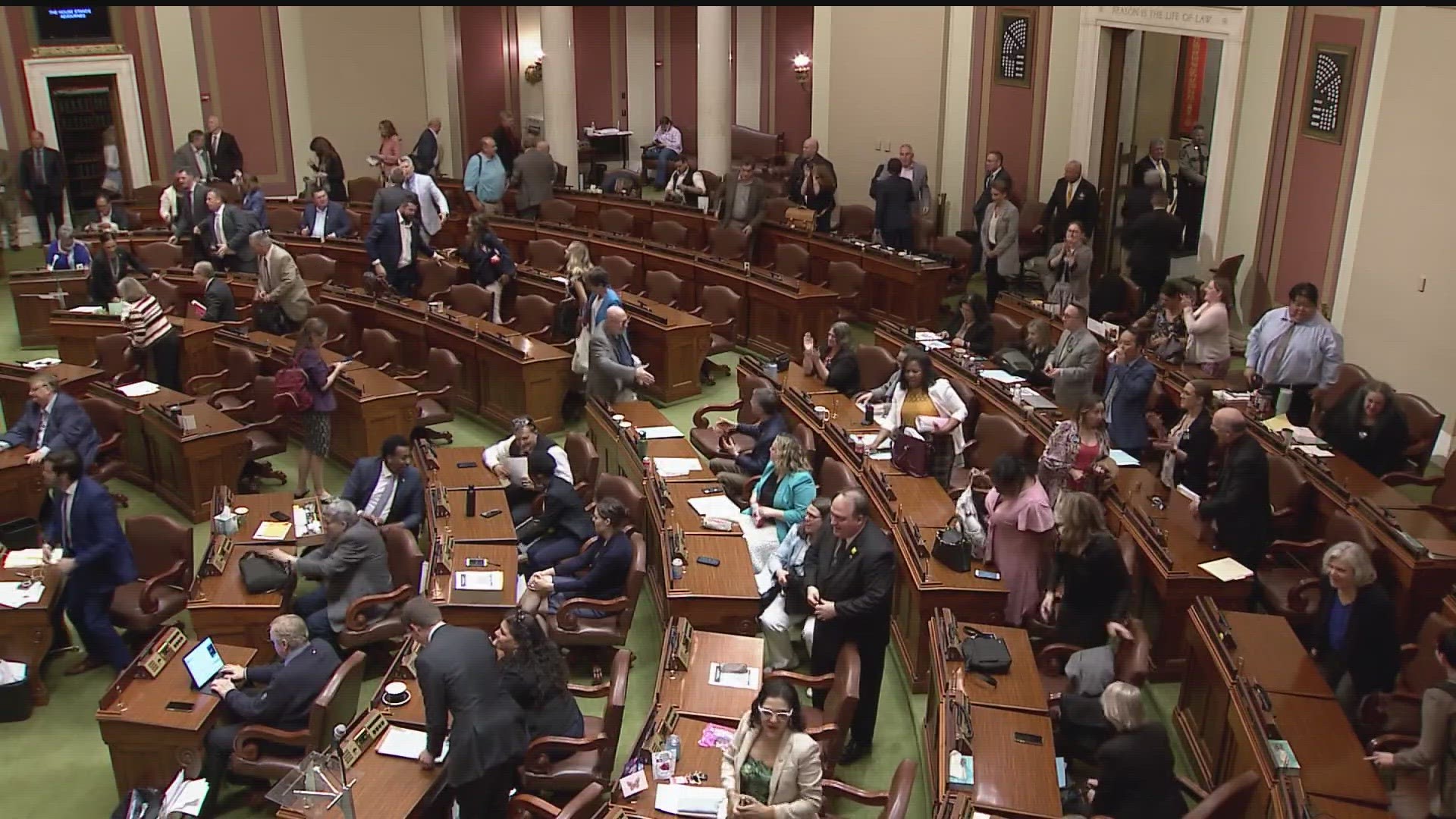

ST PAUL, Minn. — The DFL-controlled Minnesota Legislature sent 75 bills to Gov. Walz's desk this session, going far beyond the 18 pieces of legislation it took to create the state's next two-year budget.

School meals, recreational cannabis, paid leave, automatic voter registration, gun control, abortion legal protections, affordable housing, school funding, childcare credits, pre-K scholarships, nursing home aid, infrastructure, and rebate checks are just part of a long list to unpack from the 2023 Session.

"A lot of these are bills we've passed before in the Minnesota House, but they always hit the brick wall of the Republican-controlled Minnesota Senate," House Speaker Melissa Hortman, a Brooklyn Park Democrat, told KARE.

"Most people are frustrated about the partisan gridlock we’ve had in Minnesota the last 10 years. The difference this year was the DFL-led Senate."

Rep. Hortman pushed back against the GOP narrative that the DFL "trifecta" mislead voters with its aggressive agenda and targeted spending of the state's record budget surplus.

"Protecting reproductive freedom? Super popular. Paid family medical leave? Super popular. Reasonable gun violence prevention measures? Super popular," Hortman asserted.

"So, we did those things people have been waiting for the legislature to do a very long time."

Democrats assert the things they've done this session will transform the lives of Minnesotans in a positive way for generations to come. Gov. Walz often uses the term "generational impact" to describe the bills he has signed into law this year, especially those aimed at curbing childhood poverty and the state's learning disparities.

Republicans say the Democrats broke a campaign promise to give most of the surplus back to taxpayers, and instead have raised new taxes and increased both short-term and permanent spending.

"Oinky! Oinky! Piggy! Piggy! Boy, do some politicians like to spend other people's money!" Rep. Pat Garofalo told House colleagues during the final hours of the session Monday.

"Understand as we congratulate and pat each other on the back for what is an unprecedented, explosive amount of government spending in our state and now record borrowing, what does this mean for the future of Minnesota?"

Garofalo and fellow Republicans warned that the legislation Democrats are putting into law this year will be a burden for businesses and drive more entrepreneurs and companies out of the state.

Senate Minority Leader Mark Johnson said the spending levels will set the state up for a fiscal crisis in an economic downturn.

"Let's say we go into a recession, what are we going to have to do?" Sen. Johnson told KARE.

"We either raise taxes to support government or we have to start to cut services. We've created an expectation now the government's going to take care of everybody in every situation, whether you're a millionaire or low-income. So, we're going to have some real fiscal problems after this session."

The GOP contingent called out Democrats for tax increases in several of the major budget bills. The transportation bill included indexing the state's gas tax to the rate of inflation, and a 50-cent road impact fee on non-food retail deliveries of more than $100.

The same bill added a 0.75 percent sales tax -- three-quarters of one cent on the dollar -- in the seven-county Twin Cities Metro to pay for bus transit and local road projects.

The Housing bill added a 0.25 percent sales tax -- one-quarter of one cent on the dollar -- in the seven-county Metro area to support affordable housing vouchers.

Hortman pointed out that $12 million of the projected $17 million surplus is one-time money.

"When we looked at the state's one-time surplus, we spent it on one-time things. When we look at the state's ongoing needs, we had to have ongoing revenue to meet those needs."

Democrats have also taken heat for the rebate checks -- $260 per person, $520 per married couple, plus $260 per child for up to three children for a total of $1,300 for a family of five. Those checks aren't available to joint filers who make more than $150,000 per year and those single filers who earn more than $75,000.

Hortman said in her mind the surplus was returned to the people of the state because it went to helping those who need it most -- workers who bore the brunt of the pandemic in many cases.

"A lot of it will be going back to workers directly, so whether it’s a childcare worker or somebody in a nursing home, or someone who’s a nurse in a hospital."