MINNETONKA, Minn. — Bill Draxler lived independently in his Marshfield, Wisconsin home until July 2023 when he fell and broke his hip. What happened next, his son and attorney say, exposes a problem affecting seniors and their families all across America.

Medicare Advantage plans run by private insurance companies are using artificial intelligence to systematically deny skilled nursing care to elderly patients with serious health problems according to senior advocates and two class action lawsuits.

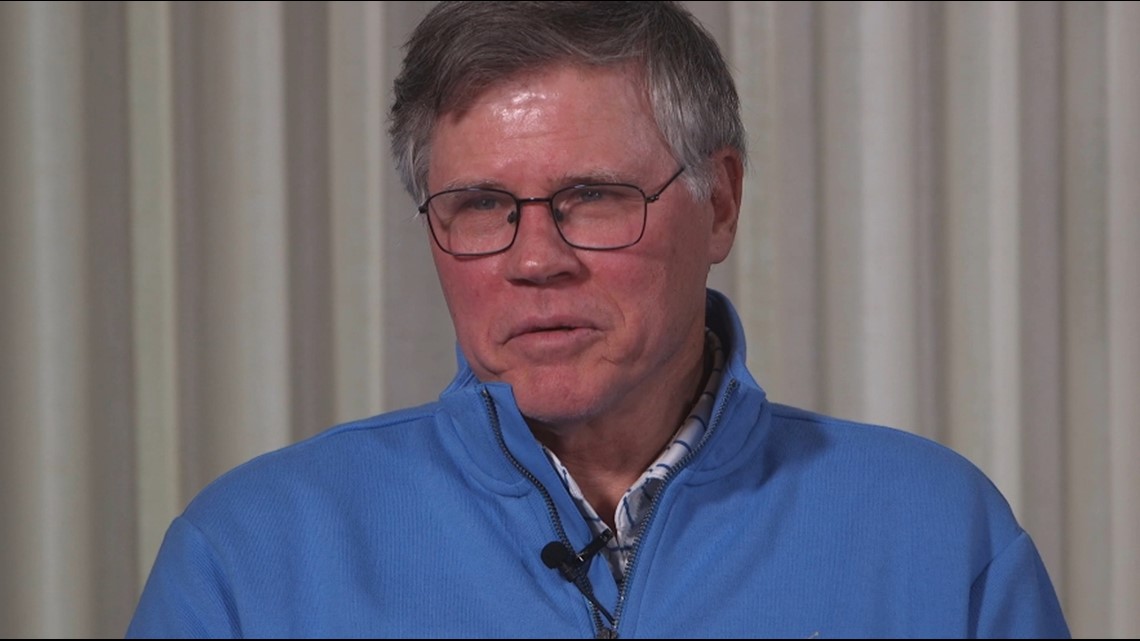

“It doesn’t seem right to me,” said Bill’s son Dave.

“It’s a huge issue and it’s growing exponentially,” explained Kelli Jo Greiner who works for the Minnesota Board on Aging.

Greiner says overcoming the AI algorithm is increasingly difficult for families.

“Very, very difficult. Because the companies rely on this as their decision maker,” she said.

The algorithm is owned by Minnetonka-based UnitedHealth Group – which is also the nation’s largest provider of Medicare Advantage plans.

An early discharge

Bill Draxler was then 96 years old when he broke his hip. After spending five days hospitalized at Marshfield Clinic, his doctors prescribed skilled nursing care to help him recover and regain strength and mobility.

His son, Dave Draxler of Edina, says at the very first care meeting he was surprised by information relayed by the skilled nursing staff.

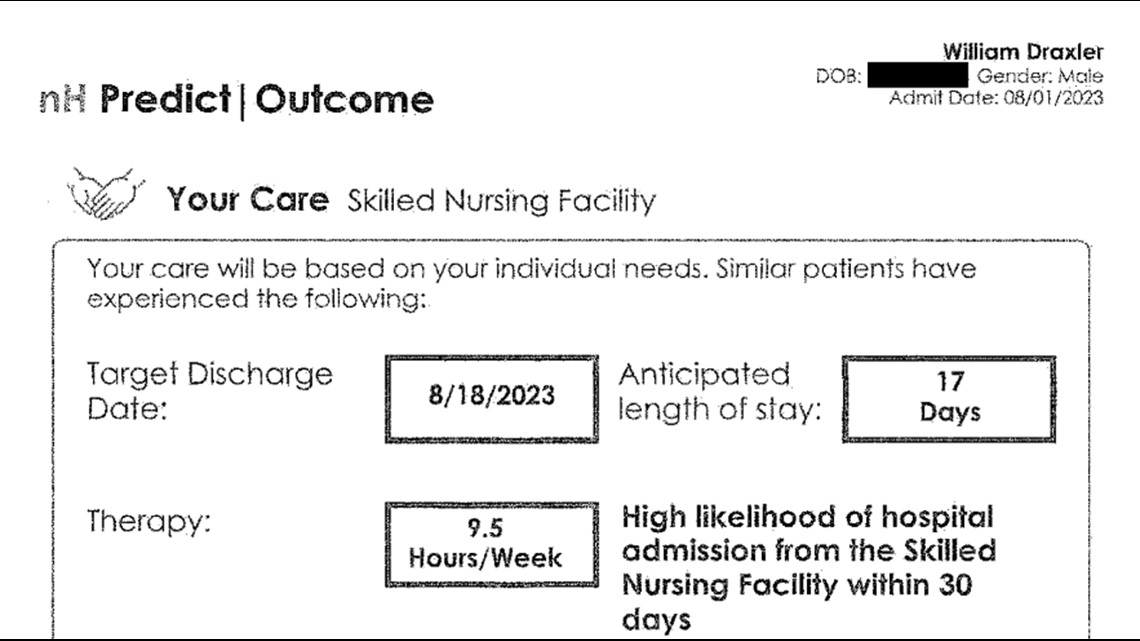

“They had what they called a predictor model based on a database of these kind of incidences,” Dave told KARE 11. That model was called “nH Predict” Outcome.

The AI algorithm predicted his dad would be receiving just 17 days of care and he should be discharged on day 18.

“Did you think it was likely he was going to be ready to leave in 18 days?” KARE 11 reporter Lauren Leamanczyk asked.

“Oh, there’s was no way he’d be ready in 18 days,” Dave replied. “We all felt that.”

Given what seemed an unrealistic prediction, Dave said he didn’t give that piece of paper much thought.

But then, on August 18th, 18 days after his father arrived at the nursing facility, Bill’s Medicare Advantage Plan said his coverage would be cut off in two days.

“He still needed total care to do anything,” Dave recalled.

Medical records show how much care he still needed. At that point, Bill’s medical team wrote he still needed “maximal assistance” just to stand up.

They said he was dependent on others to get from his bed to his wheelchair and to use the toilet.

His “Self Care Performance” score was a zero out of 12.

Bill’s family followed the appeal process, but was again denied.

They were left with a choice, let Bill return home unable to function without multiple caregivers or pay thousands of dollars out of pocket to stay in skilled nursing.

“Going home wasn’t an option, so he just had to stay there – pay privately,” Dave said.

“An Impossible System”

The AI prediction algorithm used to determine Bill Draxler’s care was created by a company called naviHealth. Insurers throughout the country use it. In 2020, naviHealth was purchased by UnitedHealth Group which also owns UnitedHealthCare.

Since that merger, lawyers and advocates say they have seen denials for skilled nursing care go through the roof.

“Our most valuable citizens are up against an impossible system,” attorney Christine Huberty told United States Senators last year at a hearing on AI-based Medicare Advantage denials.

She testified that in her practice with the Greater Wisconsin Agency on Aging Resources she has seen an increasing number of seniors with Medicare Advantage plans forced into unsafe situations.

“The insurance companies are banking on the fact that these are vulnerable adults in times of crisis and injury and that they either won’t fight the appeals. Or in some of our cases, our clients are dying in the process,” she told KARE 11. “They don’t survive the length of an appeal.”

But when they do fight, she says they almost always win.

Advantage Plans Should Follow Original Medicare Rules

That’s because Huberty says nearly all of the claims denied by Medicare Advantage plans would have been covered by Original Medicare.

More than half of eligible seniors now have a Medicare Advantage plan. The plans are run by private insurance companies which are paid by the federal government to administer them. Since the companies are paid a set amount per person covered, critics say there’s an incentive for insurers to deny services to boost profits.

Advantage plans are supposed to follow the same coverage rules as government-run Original Medicare. But Huberty says they often do not.

That assertion is backed up by a 2022 Health and Human Services Inspector General’s report. In a case study review, investigators found a pattern of improper denials. Based on the cases they examined, the Inspector General estimated Medicare Advantage Organizations “would have denied 1.5 million payment requests that met Medicare coverage rules.”

That’s why Huberty says it is important to fight denials.

“Almost always they are overturned,” she said.

But it can take months. With the average cost of skilled nursing care around $350-$400 per day, some people can’t afford to pay privately during an appeal.

With Huberty’s help, Dave Draxler took his dad’s case all the way to an administrative law hearing. Just days before a judge was set to hear the case the insurer settled.

It was four months after the original denial.

He wonders: What about all the others who don’t have an advocate?

“That part of it bothers me more than anything,” he said.

Lawsuits filed against largest Advantage providers

Joanne Barrows and her daughter Lesli say they ran into the same AI denial problem when she broke her leg in 2021.

“I assumed she would be able to get care for as long as she needed it,” Lesli said.

She knew Original Medicare covers up to 100 days of skilled nursing care after a hospital stay and assumed her mom’s Humana Medicare Advantage plan would do the same.

But Humana cut off coverage for her rehab facility after just 16 days. Lesli says her mom still couldn’t walk or use the bathroom without help and still had a catheter in.

She says they had just two days’ notice.

“It was awful,” Lesli said remembering the scramble to get her mom care.

Staying in the nursing facility without insurance coverage was too expensive, so Joanne wound up at home with Lesli.

“It wasn’t a safe situation,” she said.

Now Barrows is the lead plaintiff in a class action lawsuit accusing Humana of “illegally using AI instead of real doctors to deny coverage” creating a “financial windfall” for the company.

A separate class action suit has been filed by Wisconsin plaintiffs against UnitedHealthcare, UnitedHealth Group and naviHealth.

KARE 11 reached out to each company for a response.

Humana said:

“At Humana, we use various tools, including augmented intelligence, to expedite and approve utilization management requests and ensure that patients receive high-quality, safe and efficient care. By definition, augmented intelligence maintains a ‘human in the loop’ decision-making whenever AI is utilized. Coverage decisions are made based on the health care needs of patients, medical judgment from doctors and clinicians, and guidelines put in place by CMS.”

Optum – the arm of UnitedHealth Group that operates naviHealth wrote:

“naviHealth has helped countless members, families and caregivers navigate the health care system at critical moments with information and care planning that they otherwise wouldn’t have. Assertions that naviHealth uses a tool to deny care are false. The tool is used as a guide to help us inform providers, families and other caregivers about what sort of assistance and care the patient may need both in the facility and after returning home. Adverse coverage decisions are made by medical directors and based on Medicare coverage criteria. This lawsuit has no merit, and we will defend ourselves vigorously.”

Earlier this month the federal government sent a notice to Medicare Advantage plans warning that AI cannot be the determining factor in cutting off coverage. Since insurers already say they simply use AI as a “tool” – rather than the final factor – in coverage decisions, it is unclear what impact the notice will have.

Lesli and Dave remain frustrated, still believing the care approved for their parents was determined by a computer rather than a doctor.

To the humans behind the algorithm, Lesli has this message.

“I would want them to think about if they would want to see their mother go through this.”

How to fight back

The appeals process for Medicare Advantage can be difficult. In most cases an appeal needs to be filed within 48 hours of the denial notice – something that can be a challenge for a person in a health crisis.

Both Minnesota and Wisconsin have resources for seniors fighting what they believe are improper care denials.

In Minnesota: Senior Linkage Line. https://mn.gov/senior-linkage-line/, 800-333-2433

Advocates are available to assist in filing appeals and helping navigate the hearing process.

In Wisconsin: Greater Wisconsin Agency on Aging Resources. www.gwaar.org, 608-243-5670

Advocates and attorneys are available to help clients take their case to an administrative law judge and ensure they are receiving the coverage to which they are entitled.

Watch more KARE 11 Investigates:

Watch all of the latest stories from our award-winning investigative team in our special YouTube playlist: