ST PAUL, Minn. — More than half of Minnesota's Social Security recipients pay no state taxes on those benefits, due to a system that includes federal exclusions and state subtractions.

But the idea of making all Social Security income exempt from taxation is gaining momentum, especially as the state sits on a projected $17 billion surplus for the next two-year budget cycle.

Aurora Democrat Dave Lislegard told the House Tax Committee Thursday that it was the number one issue people raised as he went door knocking on the campaign trail last year.

The Social Security Tax is a matter of fairness for middle class retirees and an investment in financial security of Minnesotans for years to come," Rep. Lislegard told his colleagues.

According to the House Research staff there are currently 829,000 households in Minnesota receiving Social Security checks. After federal exclusions and state subtractions are applied, only 42 percent of those households — or 349,000 — face some level of state income tax liability on their Social Security checks.

Lislegard's bill, House File 300, would allow retirees to subtract all of their Social Security income from their taxable income total. It would also allow retired government employees to claim that subtraction, which is currently not allowed for certain categories of retirees.

"With the unprecedented budget surplus in Minnesota we have an historic opportunity to eliminate this tax and start protecting older Minnesotans."

A competing bill from Burnsville Democrat Jessica Hanson would make more recipients eligible for full tax exemption, but without giving up all revenue that would be lost in Lislegard's plan.

"This bill allows for a 100% subtraction for people with a gross income below $100,000 per couple, and below $62,500 for single filers," Rep. Hanson explained.

"It’s realistic, meaningful, pragmatic, and it helps Minnesotans who need it most."

Those who testified against Lislegard's bill pointed out it would translate to $1.2 billion in lost tax revenue in the next biennium, and that number would continue to grow as more people reach retirement age and start drawing Social Security checks.

"You know the rich have gotten richer during this pandemic, and as a retired doctor, so did I," Aleta Borrud told the committee. "I don't want this tax cut. I don't need this tax cut."

Opponents are concerned that once the surplus is gone, lawmakers will be forced to cut programs for children and lower income retirees.

"We do not want to pit early childhood against senior citizens, or seniors against little children. They're both valuable groups to our society, Nancy Jost of Fergus Falls told legislators.

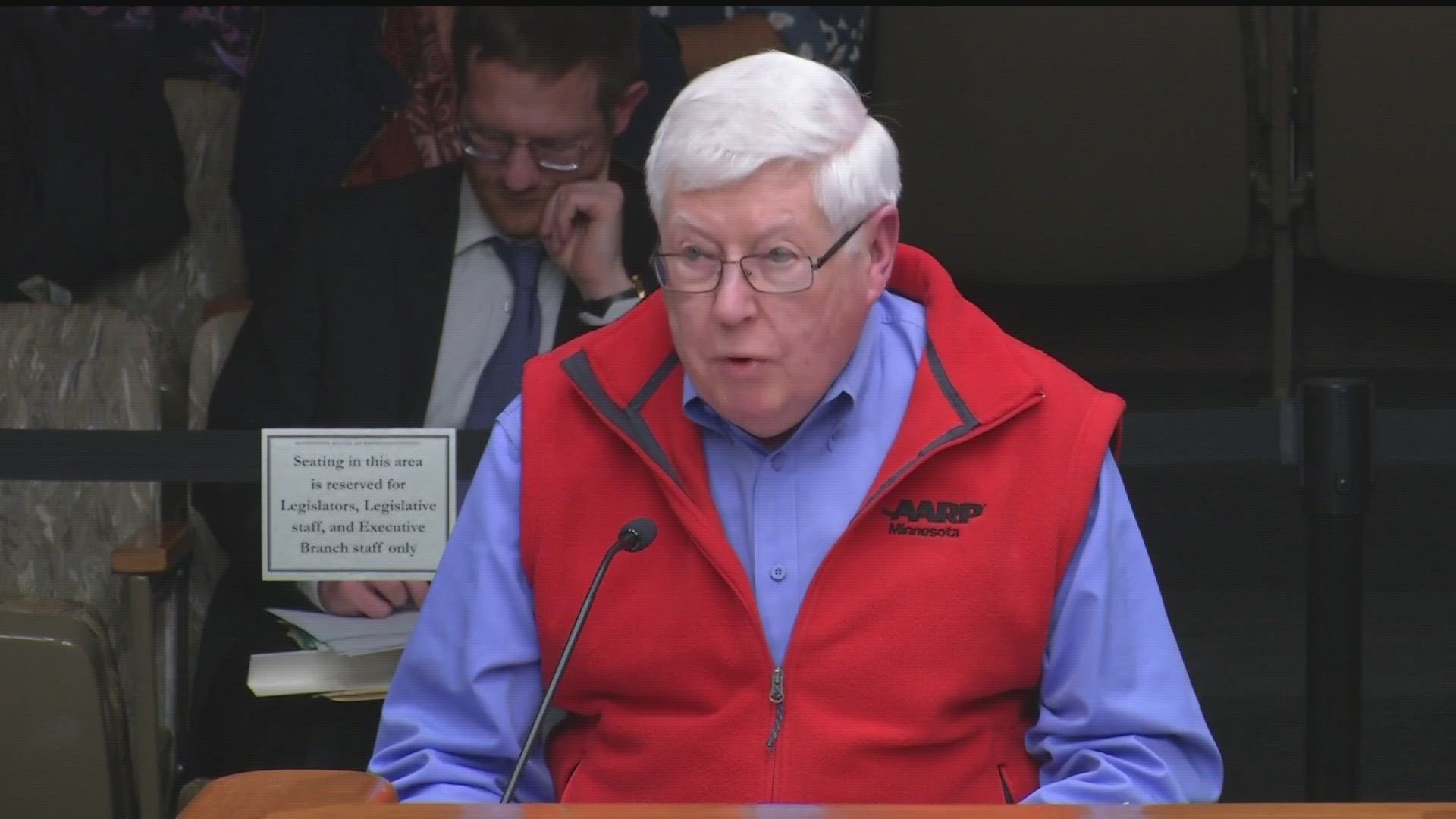

Bill Raker of AARP Minnesota said his organization has long favored full exemption of all Social Security benefits.

"We believe now is the time to stop taxing these benefits," Raker asserted.

"Historically, Social Security was designed as an anti-poverty program, not a way to fund state government."

Social Security tax exemption is also part of the Republican tax relief agenda again this year. A similar bill in the Senate is also in the works, and may be included in the final omnibus tax bill.

Governor Walz favors expanding making more people exempt from paying taxes on Social Security but doesn't agree with giving this tax break to higher income Minnesotans.