ST PAUL, Minn. — Ok, let's start with the obvious - ask 100 Minnesotans, and 99 of them would say filing income taxes is NOT among their top 10 favorite things to do.

The one who would have it on their list... would be an accountant.

But filing is something nearly everyone has to do each year, and the Minnesota Department of Revenue wants to make it less painful - and more profitable - for state residents. Here is some guidance for getting it done.

- File a return to claim the new Child Tax Credit: Beginning with tax year 2023, you could qualify for a Child Tax Credit of $1,750 per qualifying child, with no limit on the number of children claimed. This is a refundable credit, meaning you can receive a refund even if you do not owe tax. File a 2023 individual income tax return to claim the credit. Learn more about income requirements and qualifications on the Department of Revenue website.

- See if you qualify for free tax preparation: Anyone with an Adjusted Gross Income (AGI) of $79,000 or less may qualify to file electronically for free. Use the links on our website to see if you qualify for free state and federal income tax filing. You could also qualify to have your returns prepared for free through the Volunteer Income Tax Assistance (VITA) and AARP Tax-Aide programs. Click here for more info, or to find free tax preparation sites near you.

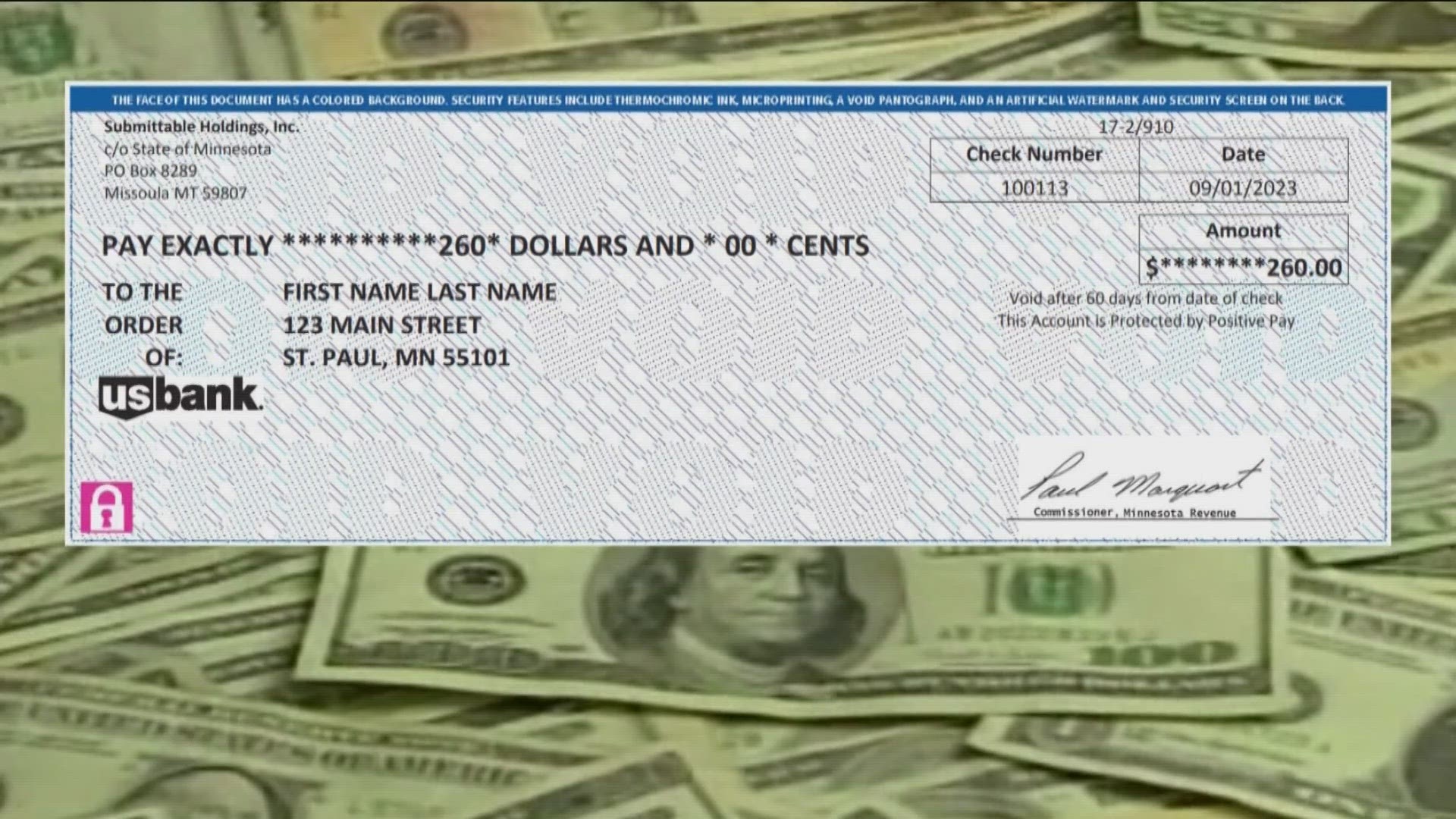

- File electronically and choose direct deposit: Electronically filing your return and having your refund directly deposited in your bank is the fastest, most secure and convenient way to file taxes and get a refund. Learn more about your electronic filing options and the benefits of choosing direct deposit.

- Save receipts and other tax-related documents: If you claim certain deductions or credits, be sure to include all required documentation when filing. Make copies of those receipts and documents in case you need to reference them in the future.

- Check for accuracy. Enter your name (and those of dependents) exactly as they appear on Social Security cards, Individual Taxpayer Identification Number (ITIN) cards or letters. Double-check bank routing and account numbers used on tax forms for direct deposit. Incorrect information can result in significant refund delays.

- File by the April 15 due date, even if you owe more than you can pay: The state urges taxpayers to pay as much as they can by the due date. Either include banking information on your electronically filed return to make the payment, or pay electronically with our e-Services Payment System. You can specify when the payment will be taken from your checking or savings account either before or on the due date. Those who don't pay the full amount will receive a bill for the remaining balance.

- Track Your Refund: Find out where your refund is in the process by using Where’s My Refund? Learn which of the four stages your refund is in and whether action is needed to allow completion of the process.

Along with the suggestions above, Revenue officials advise responding quickly if the department contacts you with requests for clarification of your return or additional support documents.

Taxpayers are also reminded that while they might file property tax returns at the same time as their income tax forms, the Department of Revenue does not begin processing property tax refunds before July 1.

You can sign up to receive an email with the latest news and updates from the Minnesota Department of Revenue by filling out this form.

WATCH MORE ON KARE 11+

Download the free KARE 11+ app for Roku, Fire TV, Apple TV and other smart TV platforms to watch more from KARE 11 anytime! The KARE 11+ app includes live streams of all of KARE 11's newscasts. You'll also find on-demand replays of newscasts; the latest from KARE 11 Investigates, Breaking the News and the Land of 10,000 Stories; exclusive programs like Verify and HeartThreads; and Minnesota sports talk from our partners at Locked On Minnesota.

- Add KARE 11+ on Roku here or by searching for KARE 11 in the Roku Channel Store.

- Add KARE 11+ on Fire TV here or by searching for KARE 11 in the Amazon App Store.

- Learn more about the KARE 11+ app for Apple TV in the Apple App Store.

- Learn more about KARE 11+ here.

Watch Take KARE of your Money:

Get the latest money-saving tips from Take KARE of your Money in our YouTube playlist: