MINNEAPOLIS — Inflation rates have fallen for the past five months, and Forbes projects them to continue falling in 2023. Despite the projected decline, we're still dealing with higher-than-normal prices and the overall financial hit of 2022.

As we head into the new year, Shannon Foreman, founder and CEO of Forethought Planning, said there are simple things you can do to stay on top of your personal finances this year.

One tip she has is to go on "dates" with your money.

"Just like you would date a partner, you need to spend time with them," Foreman said. "So you need to understand where things are. You need to know where your investments are. You need to know where your bank accounts are, what credit cards you have... what goes in, what comes out."

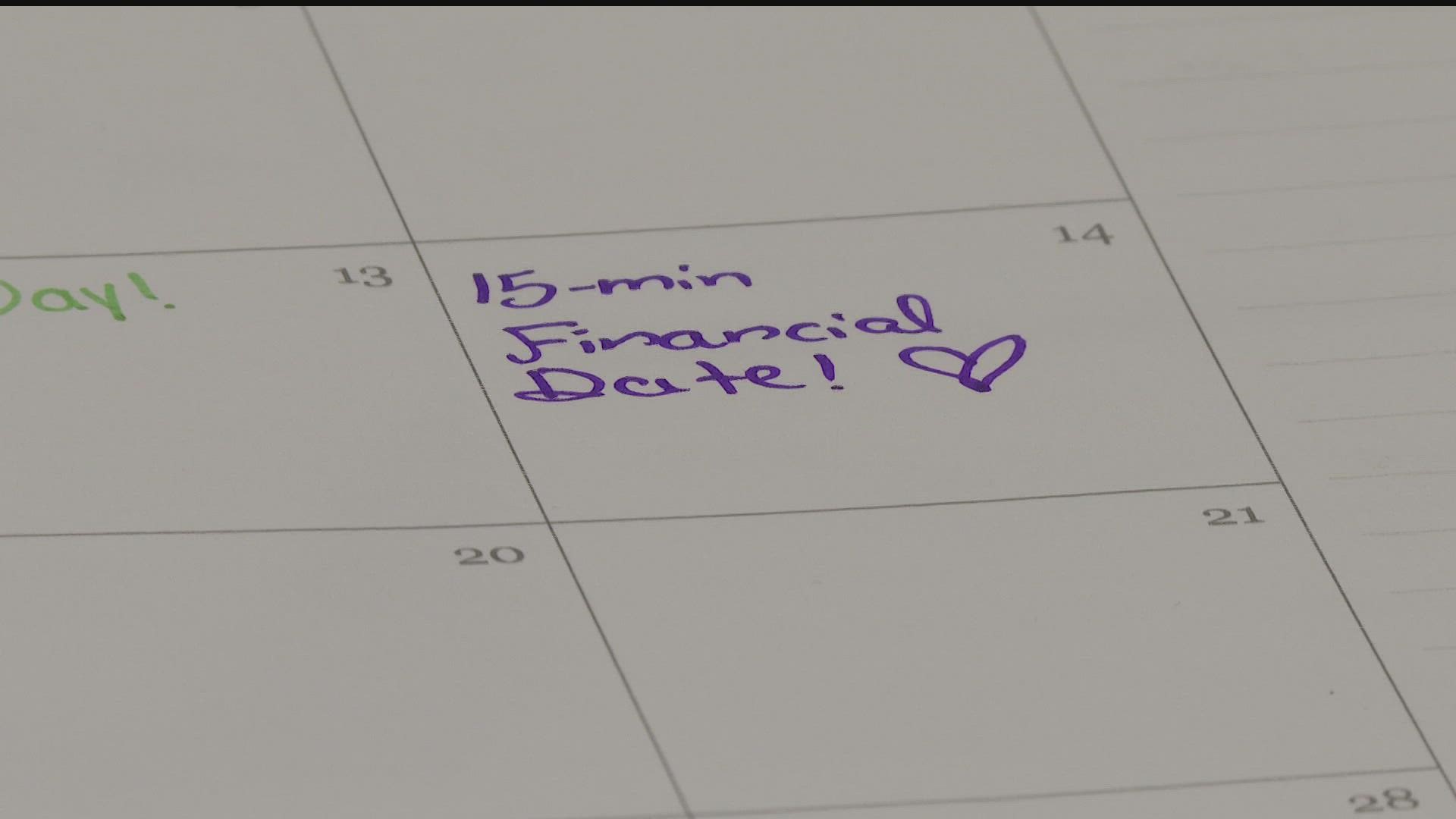

Foreman says it can be as easy as one 15-minute "date" a week... just as long as you put it in your calendar.

"If we don’t have that set time in our calendar, it’s not going to happen!" she said.

Foreman suggests people use that time to track their cash flow.

"I believe 'budget' is a dirty word," Foreman said. "I believe people associate budget with 'it’s restrictive, I can’t do anything fun.' So think about it as cash flow. Money flows and goes."

First, she says, figure out how much you should be saving.

"Once you know what you need to be saving, that’s what you have leftover to spend," she said.

If you need to cut a few things out of your monthly budget, Foreman says don't think of it as a "forever" move.

"I think sometimes when we see inflation spike, we think, 'oh none of these things are going to be ever able to be possible again.' The reality is inflation will spike, and it will level out," she said.

If you need help determining what you can keep and what you can part ways with, Foreman suggests looking inward.

"When you’re looking at, can I get my nails done, or voice lessons, or soccer or hockey for your kids… you gotta do a heart check and a values check," she said. "What is it bringing to you, and what is it providing for you? And is there a way that you could get the same thing if it didn’t cost any money?"

Lastly, Foreman said, if there's a month where you spend too much, try not to worry.

"What you have to do is re-ground yourself and say it's okay to hit the restart button. It's okay."