ST PAUL, Minn. — This is the first year of Minnesota’s child tax credit program, which is the first of its kind in America.

Parents can get up to $1,750 credit for every child under the age of 18, with no limit on the number of children. The per-child amount of the credit will vary by income.

And it’s a refundable credit, meaning even if you don’t earn enough to file taxes, you can still get this money in the form of a refund. But you’ve got to file a state tax return to take advantage of this new credit.

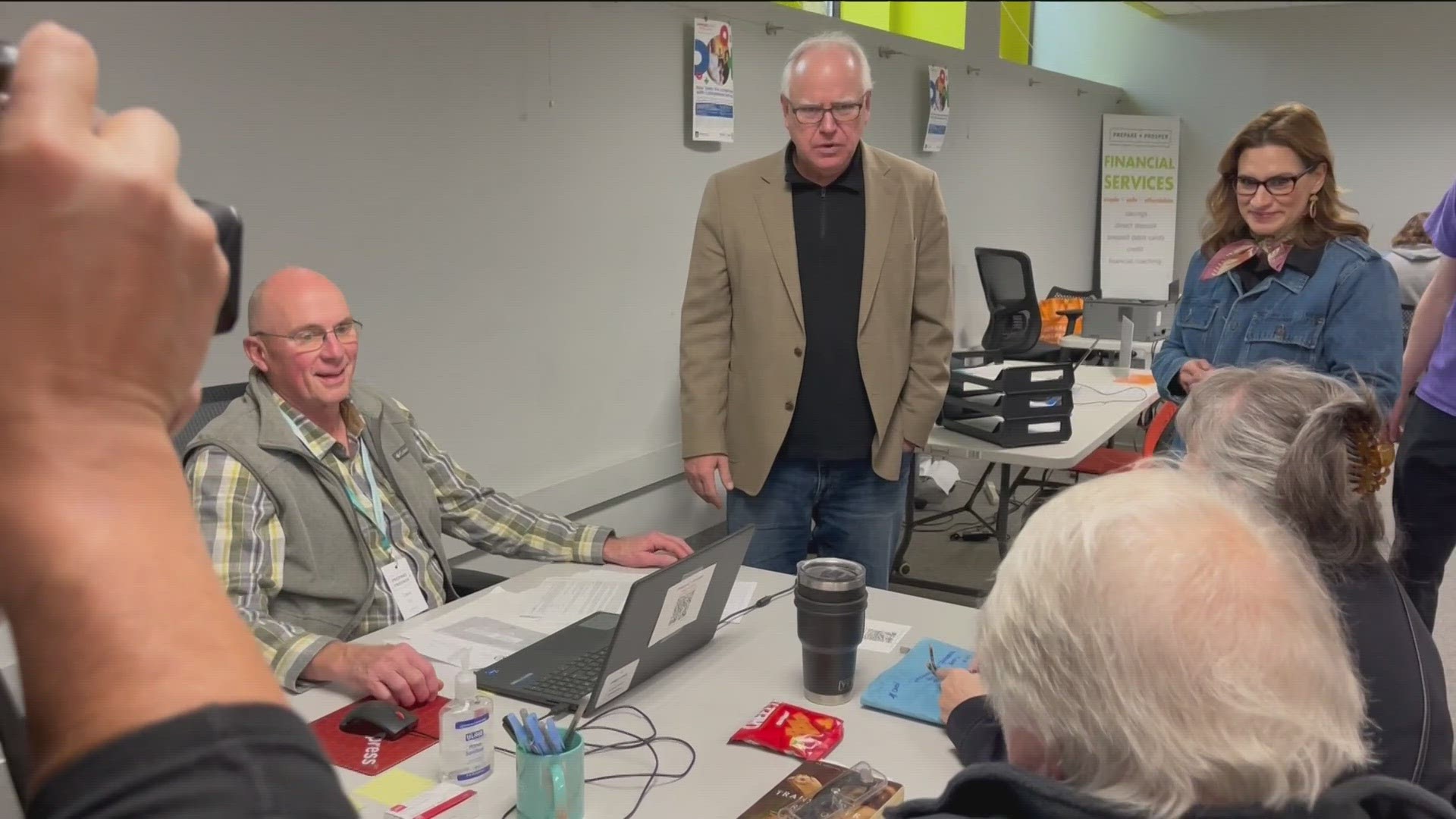

To tout the new credit, Gov. Walz, Lt. Gov. Flanagan, and Revenue Commissioner Paul Marquart Monday toured Prepare and Prosper, a St. Paul nonprofit that offers free financial coaching and tax preparation to eligible taxpayers.

Walz said thousands of families have already taken advantage of the new credit, as they filed their 2023 tax returns.

"In one week, 48,000 claimed the child tax credit. That's 25% of all returns in during the week, for $61 million with an average credit of $1,253," Gov. Walz told reporters. "That is music to our ears. That is what takes children out of poverty. That’s how we get to reducing childhood poverty in Minnesota by a third!"

The state legislature set aside $400 million to pay for the new tax credit, which should be enough even if 100% of eligible families apply for it. The state is focusing its marketing efforts on families that normally don’t file taxes because they don't earn enough to pay income taxes.

"We’re trying to get out to spaces, because the key is about that 10% of families that have not ever filed in the past, and that is the real target is those folks," Commissioner Marquart said.

The state’s also getting the word out about free tax preparation services, to help people tap into new credit. There are more than 170 sites statewide that offer free tax preparation to help people file their income tax and property tax refunds.

"We know from all our families that every single dollar counts with their tax credits and refunds and everything that is owed to our communities and families," Suyapa Miranda, Prepare and Prosper executive director, told reporters.

Those tax preparation sites are staffed by certified volunteers, including Mark Nolan at Prepare and Prosper.

"I was talking to a woman who is used to getting about the same amount back each year and when I told her, 'You’re going to get this much back,' she was like, 'Huh?!' This is why you come in," Nolan told reporters.

"It’s going to work! And it’s going to change lives!"

The maximum credit is $1,750 per child, and that phases out to zero based on family income.

The Legislature's Tax Conference Committee provided the following examples:

A married couple filing jointly with one child would receive $1,750 credit if they earn $35,000 per year or less. The most they could make and still receive some tax credit would be $52,000 per year.

A married couple filing jointly with four children would receive $7,000 if they earn $35,000 per year or less. The most they could make and still receive some tax credit would be $96,250 per year.

Commissioner Marquart urged people to look into the credit, rather than assuming they make too much to qualify.

"It phases out relatively slowly. If you have a family with four kids that phaseout doesn’t occur until about $95,000 income," Marquart said. "You might think, 'I don’t know if I qualify or not.' Find out, there’s a good chance that you do!"

WATCH MORE ON KARE 11+

Download the free KARE 11+ app for Roku, Fire TV, Apple TV and other smart TV platforms to watch more from KARE 11 anytime! The KARE 11+ app includes live streams of all of KARE 11's newscasts. You'll also find on-demand replays of newscasts; the latest from KARE 11 Investigates, Breaking the News and the Land of 10,000 Stories; exclusive programs like Verify and HeartThreads; and Minnesota sports talk from our partners at Locked On Minnesota.

- Add KARE 11+ on Roku here or by searching for KARE 11 in the Roku Channel Store.

- Add KARE 11+ on Fire TV here or by searching for KARE 11 in the Amazon App Store.

- Learn more about the KARE 11+ app for Apple TV in the Apple App Store.

- Learn more about KARE 11+ here.

Watch more local news:

Watch the latest local news from the Twin Cities and across Minnesota in our YouTube playlist: