WASHINGTON D.C., DC — Editor's note: The video above first aired on May 20, 2023.

The Internal Revenue Service (IRS) says the nearly $1 billion in state tax rebates sent to more than 2 million Minnesotans last fall will be subject to federal income taxes, despite pleas from Gov. Tim Walz and other state officials.

The federal tax hit from the checks and direct deposits could cost taxpayers between $26 and $286 apiece, depending on income and how much they received, the Star Tribune reported. The Minnesota Department of Revenue has sent a form to all recipients to use when filing federal individual income tax returns this year.

The rebate payments are not subject to state taxes.

The IRS has been insisting since December that it considers the rebates to be federally taxable income, which surprised state officials and sparked a flurry of lobbying by Walz and members of the state's congressional delegation to try to reverse that decision.

No such luck. The agency gave Minnesota a final “no” in recent letters to U.S. Reps. Pete Stauber and Angie Craig. IRS Commissioner Daniel Werfel told them the rebates didn’t count as general welfare or disaster relief, which can be excluded from federal taxes.

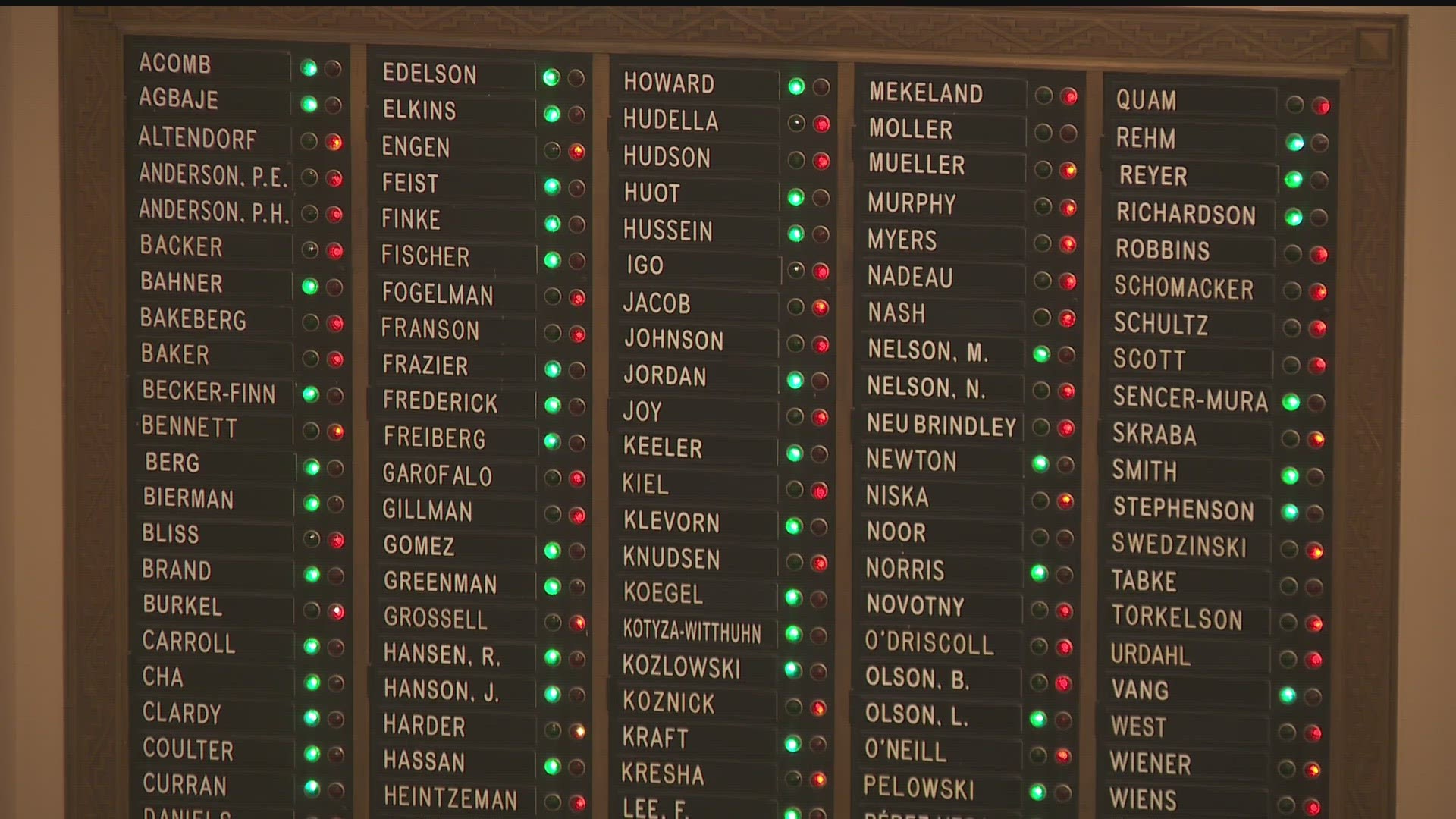

The rebates were part of a package of tax cuts approved during the 2023 legislative session to return a portion of a projected $17.6 billion budget surplus to taxpayers. Individuals were eligible for $260 if they had a gross adjusted income of up to $75,000 in 2021, and $520 for married filers who earned up to $150,000. Families could get an additional $260 rebate for up to three dependents, for a maximum of $1,300.

Stauber, a Republican, blamed “careless legislative mistakes” by the Walz administration and the Democratic-controlled Legislature in crafting the tax bill.

Walz said Minnesota was treated unfairly because the IRS decided the rebates weren’t the same as pandemic-era relief passed in other states. The federal government ended the COVID-19 health emergency May 11. Walz signed legislation authorizing the rebates nearly two weeks later on May 24.

WATCH MORE ON KARE 11+

Download the free KARE 11+ app for Roku, Fire TV, Apple TV and other smart TV platforms to watch more from KARE 11 anytime! The KARE 11+ app includes live streams of all of KARE 11's newscasts. You'll also find on-demand replays of newscasts; the latest from KARE 11 Investigates, Breaking the News and the Land of 10,000 Stories; exclusive programs like Verify and HeartThreads; and Minnesota sports talk from our partners at Locked On Minnesota.

- Add KARE 11+ on Roku here or by searching for KARE 11 in the Roku Channel Store.

- Add KARE 11+ on Fire TV here or by searching for KARE 11 in the Amazon App Store.

- Learn more about the KARE 11+ app for Apple TV in the Apple App Store.

- Learn more about KARE 11+ here.

Watch more Minnesota politics:

Watch the latest political coverage from the Land of 10,000 Lakes in our YouTube playlist: