ST PAUL, Minn. — Minnesota taxpayers, keep an eye on your bank accounts.

A significant number of Minnesotans are starting to receive one-time tax rebate payments approved by the legislature last session out of the state's multi-billion dollar budget surplus. Revenue Commissioner Paul Marquart told reporters Wednesday that 200,000 checks were electronically sent out late Tuesday night.

Gov. Walz heavily pushed the legislature to deliver "Walz checks" back to taxpayers in his annual budget, though that is not the official name of the payments, and the amounts were ultimately lower than the governor was originally hoping for.

Taxpayers won't need to do anything to receive the payments; the money will be automatically sent by direct deposit or mailed by check based on 2021 income tax returns. The one exception is if you've moved or changed bank accounts since filing your 2021 return and missed the July deadline to update your information with the state.

"If you did not provide updated address or bank information, we will use the information on your 2021 Minnesota Income Tax Return or Property Tax Refund to send your payment," said the state tax rebate web portal. "Any failed direct deposit attempts will result in a check mailed to the address on that return."

Here's everything you need to know about the checks:

Who's eligible for a tax rebate payment?

Anyone who lived in Minnesota in 2021 and filed an income tax return or property tax refund is eligible as long as they meet the limits on adjusted gross income in their 2021 tax return ($75,000 or less for single filers, $150,000 or less for married couples who filed together).

Who isn't eligible?

Taxpayers who exceed the adjusted gross income limits, those claimed as dependents, and taxpayers who died before Jan. 1, 2023.

How do I apply?

You don't need to apply. There is no application or form to fill out; rebates will be sent automatically based on income tax returns for tax year 2021, including the adjusted gross income amount, mailing address, and direct deposit information if provided.

How much will I receive?

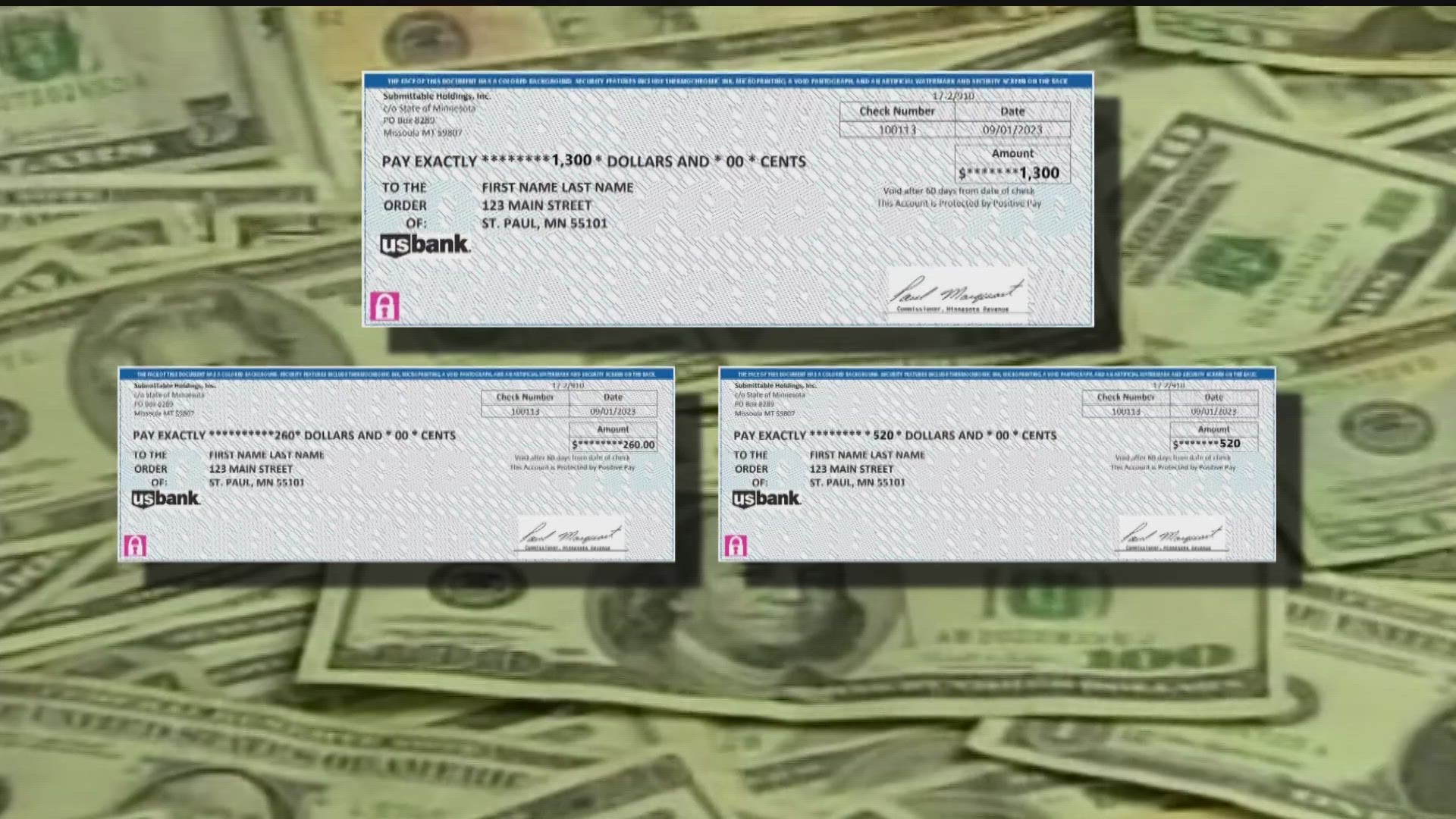

- $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021

- $520 for married couples who filed jointly with an adjusted gross income of $150,000 or less in 2021

- $260 each for up to three dependents, if taxpayers met the adjusted gross income requirements; that could mean a maximum check of $1,300 for married couples with three dependents.

When will I receive the payment?

Payments will be processed and are now starting to arrive in bank accounts.

What if I still have questions?

More information can be found on the Minnesota Department of Revenue's website.

WATCH: Gov. Tim Walz discusses the rebate check rollout:

Watch more local news:

Watch the latest local news from the Twin Cities and across Minnesota in our YouTube playlist:

WATCH MORE ON KARE 11+

Download the free KARE 11+ app for Roku, Fire TV, Apple TV and other smart TV platforms to watch more from KARE 11 anytime! The KARE 11+ app includes live streams of all of KARE 11's newscasts. You'll also find on-demand replays of newscasts; the latest from KARE 11 Investigates, Breaking the News and the Land of 10,000 Stories; exclusive programs like Verify and HeartThreads; and Minnesota sports talk from our partners at Locked On Minnesota.

- Add KARE 11+ on Roku here or by searching for KARE 11 in the Roku Channel Store.

- Add KARE 11+ on Fire TV here or by searching for KARE 11 in the Amazon App Store.

- Learn more about the KARE 11+ app for Apple TV in the Apple App Store.

- Learn more about KARE 11+ here.